6 Rules I've Learned From 6 Years of Trading

PT14M53S

PT14M53S PT14M53S

PT14M53S PT1H3M14S

PT1H3M14S PT26M1S

PT26M1S PT51M26S

PT51M26S PT18M39S

PT18M39S PT42M38S

PT42M38S PT22M54S

PT22M54S PT18M54S

PT18M54S PT1H7M16S

PT1H7M16S PT2H9M48S

PT2H9M48S PT1H15M41S

PT1H15M41S PT42M

PT42M PT50M56S

PT50M56S PT43M11S

PT43M11S PT18M37S

PT18M37S PT47M9S

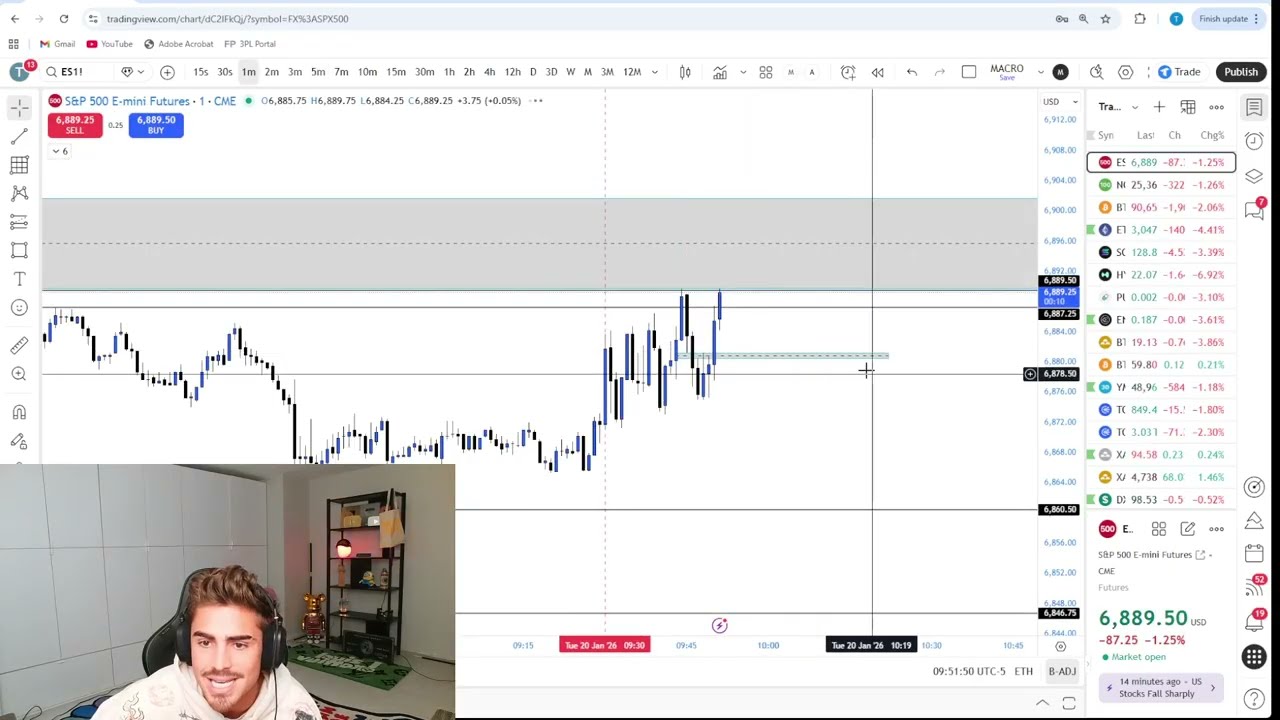

PT47M9SIn this live stream the trader walks through pre‑market analysis of ES and NASDAQ, evaluates bullish and bearish SMT divergences, 4‑hour gap inversions, and risk management before the market opens. After a volatile start he reverses a losing month, securing roughly $73 k‑$93 k in profit on the day while detailing position sizing, stop‑loss adjustments, and his plan to hit the final take‑profit target.

PT26M49S

PT26M49SIn this live day‑trading session the streamer anxiously watches NASDAQ and ES price gaps, repeatedly flipping between bullish and bearish bias as he tries to catch short‑term reversals, only to see the market invalidate his entries and stack massive losses. The chaotic commentary culminates in a staggering $161,430 loss, pushing his monthly deficit past $220 K while he vents frustration at the chat and his own trading decisions.

PT30M56S

PT30M56SIn this tutorial, the instructor breaks down how to determine daily market bias by analyzing high‑time‑frame trends, liquidity draws, and fair‑value gaps, then walks through live bearish and bullish examples that illustrate where price is likely to move and where entry targets may lie. He also previews the next session on risk management and trade execution, linking bias identification to actionable trading plans.

PT34M25S

PT34M25SIn this live stream the trader reacts to PPI news, applying bearish SMT patterns, fair‑value gap analysis and liquidity draws on NQ, ES, and NASDAQ to time short entries as the market opens. After fast‑paced trading, multiple profit‑taking moves and stop‑loss adjustments, the session wraps up with a reported profit of $67,680.

PT19M37S

PT19M37SIn this video the creator breaks down how prop‑firm funded accounts work, why they’re a powerful tool for low‑capital traders, and what skills are required to pass the evaluation challenges, while comparing the main plans from Alpha Futures and Tradeify. He also shares detailed account rules, payout structures, and exclusive discount codes (TJR40 and TJR) to help viewers save on activation fees.

PT11M1S

PT11M1SIn this video the instructor breaks down the three major trading sessions (Asian, London, and New York) and highlights the critical New York‑time windows—9:30‑9:50 a.m. ET for market manipulation and 9:50‑10:10 a.m. ET for optimal entry—illustrating how recognizing these periods can boost high‑probability daily trades on US indexes. Real‑time chart examples demonstrate the pattern, and the presenter previews the next lesson on funded accounts and prop‑firm strategies.

PT16M4S

PT16M4SThis video breaks down SMT (Smart Money Transfer) divergence, showing how comparing the S&P 500 and NASDAQ highs and lows during significant liquidity draws can reveal early trend‑change signals. It then demonstrates how to identify bullish and bearish divergences, distinguish the leading from the lagging index, and apply the concept for trade bias across multiple timeframes.

PT14M24S

PT14M24SIn this tutorial, TJR breaks down the equilibrium confluence, showing how to draw it from the most recent swing low to high in an uptrend (or high to low in a downtrend) to identify premium and discount zones for trend‑continuation trades. He also demonstrates using equilibrium alongside fair‑value gaps and liquidity sweeps across multiple time frames, emphasizing its role in spotting retracement entry points and maximizing profitability.

PT22M31S

PT22M31S.In this lesson, TJR breaks down inverse fair value gaps—fair value gaps that are disrespected within the prevailing trend—and shows how they can be used as a confirmation confluence to spot trend changes before a traditional break of structure. Real‑time chart examples illustrate entry timing, risk‑to‑reward improvements, and handling stacked gaps, preparing traders for the next continuation confluence (equilibrium).

PT23M4S

PT23M4S.In this advanced session the instructor breaks down several types of market imbalances—including new‑day, new‑week and new‑candle opening gaps and the BPR (imbalanced price range) pattern—explaining how they can serve as entry points or price targets and illustrating each concept with live chart examples. He also revisits fair‑value gaps, shows how they interact with these imbalances, and tees up a follow‑up video on inverse fair‑value gaps.

PT1H3M37S

PT1H3M37S.In this live day‑trading stream the host dissects London, Asia and New York session dynamics, attempts short‑term shorts on NASDAQ and ES using high‑timeframe confluences, and battles poor fills and volatile price swings that culminate in a $97,421 loss, leaving him $122 K down for the week. He then reflects on the pitfalls of chasing drawdowns, the importance of disciplined risk management, and his plans around upcoming economic releases like non‑farm payroll.

PT13M55S

PT13M55SIn this high‑energy live session the trader scalps the 1‑minute chart, using triple equal highs and five‑minute low sweeps on ES and NASDAQ to trigger a rapid long, ultimately locking in $42,510 profit in minutes. The video walks through his real‑time decision‑making, stop‑loss adjustments, and exit strategy while highlighting the volatility and psychological dynamics of ultra‑short‑term day trading.

PT33M43S

PT33M43S.In this video the creator breaks down fair value gaps—three‑candle imbalances where the top wick of the first candle and the bottom wick of the third leave a price void—and shows how to spot bullish and bearish gaps, why they matter for trend continuation, and how to treat stacked gaps, respecting or discarding them based on subsequent price action. Viewers also learn common pitfalls, how to identify gaps that are “disrespected,” and how to integrate FVGs with other confluences for a more reliable trading strategy.

PT44M44S

PT44M44SJoin the streamer as he navigates the market open, targeting equal low liquidity zones and PMI releases to execute a live day‑trade that ultimately nets $25,400 in profit. Throughout the session he explains his use of session highs/lows, SMT divergences, and risk‑management tactics while reacting to chat and market swings.

PT12M23S

PT12M23SIn this quick lesson, the instructor breaks down “break of structure” — the point where bullish or bearish market patterns flip when a candle closes below the most recent low or above the most recent high — and shows how to spot these shifts on real‑time charts. He also explains how this confluence works alongside liquidity sweeps and fair‑value gaps to confirm order‑flow changes and improve trade entry decisions.

PT53M44S

PT53M44SIn “Path to Profitability: Advanced Liquidity Concepts,” the host breaks down high‑probability liquidity draws—including session, daily, and low‑resistance highs and lows—and shows how new money from Asian, London, and New York sessions manipulates these levels to create trading opportunities. Real‑chart examples illustrate how to identify and use these liquidity zones for both entry and exit points, giving traders a clearer edge in the market.

PT10M40S

PT10M40S.In this live recap TJR Trading walks viewers through his first New‑Year trade, which was liquidated for about $99,500 as a short on the Nasdaq/E‑mini despite multiple high‑time‑frame and low‑time‑frame SMT divergences, a fair‑value‑gap fill, and a break of structure. He then breaks down the bullish macro news that triggered the stop‑loss, and promotes his daily “Path to Profitability” series and mentorship program that offers live coaching and trade reviews for aspiring traders.

PT35M39S

PT35M39SIn this episode TJR breaks down liquidity as the resting buy and sell orders that cluster above recent highs and below recent lows, explaining how these clusters drive price movement and give market makers the order flow they need to push trends. He then demonstrates chart examples of liquidity sweeps, reveals why most retail traders trade the wrong side, and outlines a basic framework for using this insight to improve trade timing.

PT41M15S

PT41M15SIn this beginner‑focused episode, the host walks viewers through setting up TradingView, explains Japanese candlestick anatomy, and shows how to spot highs, lows, and trends across multiple time frames. He also contrasts technical versus fundamental analysis and outlines the basic concepts needed to predict price moves before diving into advanced liquidity and imbalance strategies.

PT22M31S

PT22M31SIn day two of the Path to Profitability series, the instructor stresses that trading is fundamentally about mastering the skill of predicting price action with high probability—not about trying to make money directly. By adopting a mindset focused on continuous skill development, disciplined analysis, and detaching emotion from profit, viewers learn how to shift from unprofitable habits to consistent profitability.

PT39M56S

PT39M56SIn this video the creator discards a contrived motivational intro and announces a month‑long series of raw, daily trading lessons—covering strategy, psychology, risk management and advanced confluences—delivered for free throughout January (and possibly into February). He then urges viewers to abandon complacency, set specific, numeric goals (e.g., $100,000 by year‑end), break them into weekly and daily targets, and take relentless, accountable action to turn 2026 into a profitable year.

PT38M34S

PT38M34SIn this full vlog, the creator shares their exciting experience of attending the Jake Paul vs. Anthony Joshua fight after placing a $250,000 bet on the outcome. Join them as they discuss high-stakes gambling, showcase luxury watches, and provide insights into the emerging world of prediction markets with Poly Market.

PT11M9S

PT11M9SIn this heartfelt holiday message, the speaker expresses deep gratitude for life and the importance of appreciating every moment, especially during the Christmas season. They encourage viewers to pursue their dreams relentlessly, embrace discomfort for growth, and cherish the relationships and opportunities they have, reminding everyone to live life to the fullest.

PT33M22S

PT33M22S PT15M7S

PT15M7SIn this empowering video, the speaker encourages viewers to take action towards their dreams, emphasizing that there is never a perfect time to start and that prioritizing personal goals over societal expectations is crucial for happiness. As the year 2026 approaches, he reflects on his own journey of growth and urges everyone to make the most of their time, pursue their authentic selves, and take that first step towards achieving their dream lives.