Something Is Not Adding Up…

PT20M45S

PT20M45S PT20M45S

PT20M45S PT20M59S

PT20M59S| Metric | Observed | Expected |

|---|---|---|

| Views | 43,740 | 46,712.5 |

| Likes | 2,094 | 2,310.5 |

PT24M45S

PT24M45S| Metric | Observed | Expected |

|---|---|---|

| Views | 81,176 | 46,174 |

| Likes | 3,651 | 2,346 |

PT23M49S

PT23M49S| Metric | Observed | Expected |

|---|---|---|

| Views | 54,246 | 46,174 |

| Likes | 2,631 | 2,346 |

PT22M38S

PT22M38S| Metric | Observed | Expected |

|---|---|---|

| Views | 62,870 | 43,670 |

| Likes | 2,664 | 2,187 |

PT22M15S

PT22M15S| Metric | Observed | Expected |

|---|---|---|

| Views | 56,596 | 43,670 |

| Likes | 2,208 | 2,187 |

PT26M25S

PT26M25S| Metric | Observed | Expected |

|---|---|---|

| Views | 86,527 | 43,670 |

| Likes | 3,162 | 2,187 |

PT23M34S

PT23M34S| Metric | Observed | Expected |

|---|---|---|

| Views | 53,885 | 43,670 |

| Likes | 2,404 | 2,187 |

PT25M49S

PT25M49S| Metric | Observed | Expected |

|---|---|---|

| Views | 69,477 | 46,619 |

| Likes | 2,760 | 2,225 |

PT16M9S

PT16M9S| Metric | Observed | Expected |

|---|---|---|

| Views | 50,345 | 46,619 |

| Likes | 2,191 | 2,225 |

PT15M54S

PT15M54S| Metric | Observed | Expected |

|---|---|---|

| Views | 45,501 | 46,619 |

| Likes | 2,122 | 2,225 |

PT20M42S

PT20M42S| Metric | Observed | Expected |

|---|---|---|

| Views | 53,161 | 46,619 |

| Likes | 2,238 | 2,225 |

PT21M2S

PT21M2S| Metric | Observed | Expected |

|---|---|---|

| Views | 55,804 | 46,619 |

| Likes | 2,351 | 2,225 |

In this episode Thomas Atinson breaks down the market’s 2026 turning point, from BlackRock’s historic $14 trillion assets‑under‑management milestone and a rotation out of the “Magnificent 7” mega‑caps into small‑cap, commodities and crypto opportunities, to the surge in dark‑pool activity and options flows shaping today’s trades. He also warns of mounting volatility in silver and other metals, analyzes the S&P‑500’s head‑and‑shoulders pattern, and offers a concise outlook for investors and traders navigating the evolving macro landscape.

PT20M17S

PT20M17S| Metric | Observed | Expected |

|---|---|---|

| Views | 48,368 | 46,619 |

| Likes | 2,055 | 2,225 |

In this episode Thomas Atinson breaks down the volatile start to 2026, highlighting a record dark‑pool trade, a broad market rotation where over 60 % of stocks rose even as the Nasdaq fell, and the impact of a Trump tweet that erased billions from oil and equity markets. He also examines sector dynamics such as the Russell 2000 out‑performing the S&P, aggressive moves in Bitcoin and silver ETFs, and offers actionable insights for traders navigating the emerging stock‑pickers environment.

PT19M58S

PT19M58S| Metric | Observed | Expected |

|---|---|---|

| Views | 39,324 | 46,619 |

| Likes | 1,928 | 2,225 |

In this episode Thomas Atinson breaks down Wall Street’s 2026 strategy, focusing on the critical 94,500 level that could squeeze crypto assets, the Russell 2000’s outperformance over the S&P, and the latest options‑driven moves across stocks, commodities and digital currencies. He spotlights bullish signals such as a Bitcoin gamma squeeze toward $104‑$106, rising oil and silver prices, and key technical thresholds for Tesla and Nvidia, while urging viewers to watch sector rotation and stay tuned for upcoming trading opportunities.

PT26M26S

PT26M26S| Metric | Observed | Expected |

|---|---|---|

| Views | 61,909 | 46,619 |

| Likes | 2,452 | 2,225 |

Thomas Atinson breaks down the latest market dynamics, spotlighting unprecedented dark‑pool activity in Bitcoin, silver and the Magnificent 7, the upcoming CPI release, and mixed signals from inflation, Fed policy and earnings that could shape markets through 2026. He also examines sector breadth improvements, AI‑driven growth and potential short‑squeeze scenarios while offering actionable insights for traders navigating the evolving macro landscape.

PT18M20S

PT18M20S| Metric | Observed | Expected |

|---|---|---|

| Views | 49,676 | 46,619 |

| Likes | 2,278 | 2,225 |

. Good.In this episode Thomas Atinson breaks down why the first five trading days of 2026 are a crucial barometer, showing a surprise S&P 500 upturn, a historic tech‑sector underperformance versus broader sector strength, widening credit‑default spreads, rising unemployment signals, and a shift from growth to value that together hint at a potentially volatile Q1. He also spotlights a fresh Bitcoin rally, key support levels to watch, upcoming earnings‑season risks, and urges viewers to monitor these “canary” indicators while noting the video’s sponsor, Tiger Brokers.

PT25M7S

PT25M7S| Metric | Observed | Expected |

|---|---|---|

| Views | 46,319 | 46,619 |

| Likes | 2,270 | 2,225 |

In this episode Thomas Atinson breaks down the crucial first‑five‑day market statistics for 2026, highlighting the surge in precious metals—silver up 13.5 % and platinum up 17.5 %—the all‑time high in Dow Jones transportation averages, a potent silver squeeze, and massive Bitcoin ETF inflows. He also examines the impact of a missing Santa‑Claus rally, volatile options flow, shifting tech‑sector dynamics, and upcoming macro events such as non‑farm payrolls, offering viewers actionable edge for the year ahead.

PT20M37S

PT20M37S| Metric | Observed | Expected |

|---|---|---|

| Views | 44,623 | 46,619 |

| Likes | 2,171 | 2,225 |

. Good.In this episode, Thomas Atinson breaks down the fallout from a missed 2026 Santa Claus rally, highlighting bearish January stats, rising Bitcoin ETF flows, and mixed signals across stocks, commodities, and energy while pointing out potential short‑squeeze zones and lead indicators like the Russell 2000 and yield curves. He also examines the bullish momentum in metals such as copper and silver, the resilience of small‑cap stocks versus the S&P 500, and upcoming catalysts like non‑farm payrolls, urging viewers to watch for liquidity traps and avoid FOMO.

PT25M26S

PT25M26S| Metric | Observed | Expected |

|---|---|---|

| Views | 61,522 | 46,619 |

| Likes | 2,598 | 2,225 |

Thomas Atinson breaks down the fallout from the U.S. capture of Venezuelan leader Maduro and the revelation of 300 billion barrels of oil, exploring how the news is already driving oil, energy, and metal markets higher and hinting at possible inflation or deflation in 2026. He also examines the ripple effects on distressed‑debt trades, energy stocks, and the crypto market—especially Bitcoin’s breakout—while warning of heightened volatility ahead of key economic data releases.

PT31M8S

PT31M8S| Metric | Observed | Expected |

|---|---|---|

| Views | 59,148 | 46,619 |

| Likes | 3,135 | 2,225 |

The video breaks down the massive $130‑per‑ounce physical silver price in Tokyo versus $72 paper contracts, exposing an unprecedented arbitrage gap driven by tighter margin requirements, retail pressure and geopolitical metal demand, and warns that this extreme volatility is only the beginning of 2026. It then expands to the wider macro picture—highlighting hefty dark‑pool trades in the S&P 500, shifting earnings trends, and looming currency‑ and yield‑curve dynamics—providing viewers with the key to watch as markets navigate the year’s uncertain turbulence.

PT30M55S

PT30M55S| Metric | Observed | Expected |

|---|---|---|

| Views | 69,758 | 46,619 |

| Likes | 3,013 | 2,225 |

In today's video, Thomas Atinson discusses the shocking $429 million worth of calls opened in silver and the implications of a potential massive short squeeze, while also analyzing the bullish trends observed in gold, platinum, and commodities as we enter 2026. With central banks actively stacking precious metals amidst concerns over market liquidity and volatility, Atinson raises critical questions about the future of the financial system and the behavior of investors in this dynamic landscape.

27:43

27:43| Metric | Observed | Expected |

|---|---|---|

| Views | 47,961 | 46,619 |

| Likes | 2,376 | 2,225 |

In this insightful video, Thomas Atinson analyzes the potential for a Santa Claus rally as we approach the end of the year, discussing economic indicators and market trends that may influence stock and cryptocurrency performance in 2025 and beyond. He highlights surprising statistics about gold's performance during the holiday season and explores which investments might yield the best returns, encouraging viewers to stay informed and think strategically about their market choices.

22:50

22:50| Metric | Observed | Expected |

|---|---|---|

| Views | 50,774 | 46,619 |

| Likes | 2,356 | 2,225 |

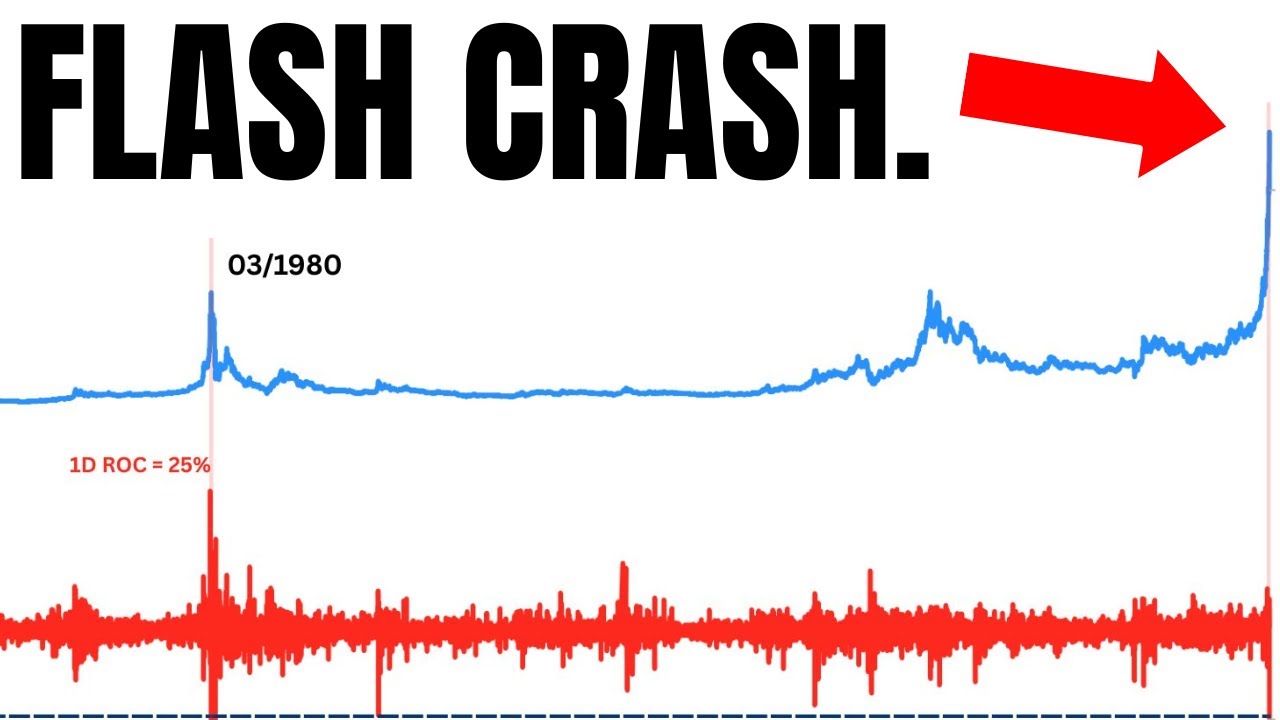

In this video, Thomas Atinson analyzes the potential impact of the upcoming Bank of Japan interest rate hike on Bitcoin and the broader financial markets, revealing that a significant historical drop of 25% could repeat. He dives into recent inflation data, Wall Street's activities leading into the year-end, and what traders and investors should watch for as the market navigates these crucial developments.

58:08

58:08| Metric | Observed | Expected |

|---|---|---|

| Views | 3,326 | 46,619 |

| Likes | 279 | 2,225 |

Join us for a live discussion as we kick off the US stock market's opening on December 22nd, just ahead of the holiday season. The focus is on the impressive performance of precious metals, with platinum and silver seeing significant gains, as we explore potential trends and the prospect of a Santa Claus rally in the markets.

20:32

20:32| Metric | Observed | Expected |

|---|---|---|

| Views | 43,947 | 46,619 |

| Likes | 2,188 | 2,225 |

In this video, Thomas Atinson discusses the unprecedented cluster trade on Wall Street's largest exchange-traded funds just in time for the Christmas season, raising questions about the market's potential direction. He dives deep into current market trends, including liquidity crises in metals, volatility in crypto assets, and key figures affecting stocks, while preparing viewers for possible upcoming shifts in the financial landscape.

23:22

23:22| Metric | Observed | Expected |

|---|---|---|

| Views | 43,545 | 46,619 |

| Likes | 2,152 | 2,225 |

In this video, Thomas Atinson analyzes the recent unemployment trends and their potential implications for the US economy, questioning whether we are heading towards a recession. He discusses insights from Tom Lee regarding market opportunities while also exploring the latest trends in stocks, commodities, and cryptocurrencies.

24:09

24:09| Metric | Observed | Expected |

|---|---|---|

| Views | 42,722 | 46,619 |

| Likes | 2,079 | 2,225 |

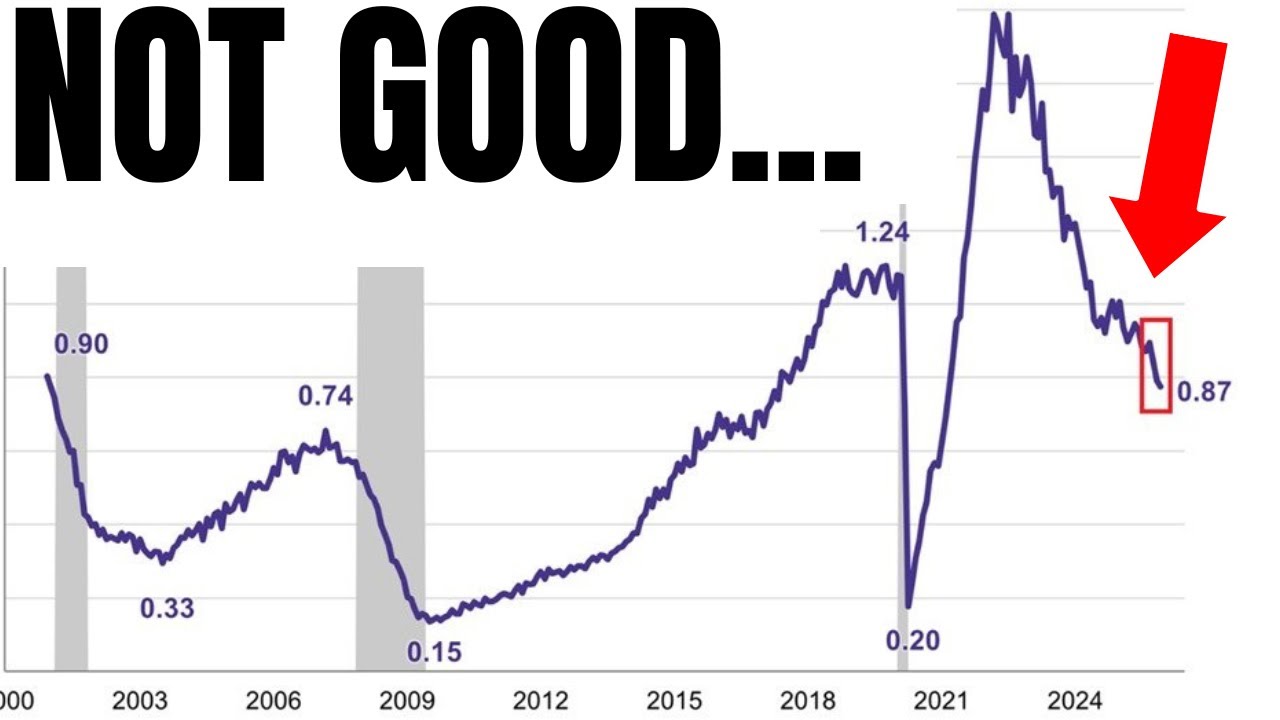

In this video, Thomas Atinson discusses unusual movements in the VIX indicating potential market volatility, analyzing their historical correlations with market downturns. He also explores current trends in stocks, commodities, and cryptocurrencies, offering insights into potential opportunities amidst market uncertainty.

30:44

30:44| Metric | Observed | Expected |

|---|---|---|

| Views | 58,632 | 46,619 |

| Likes | 2,568 | 2,225 |

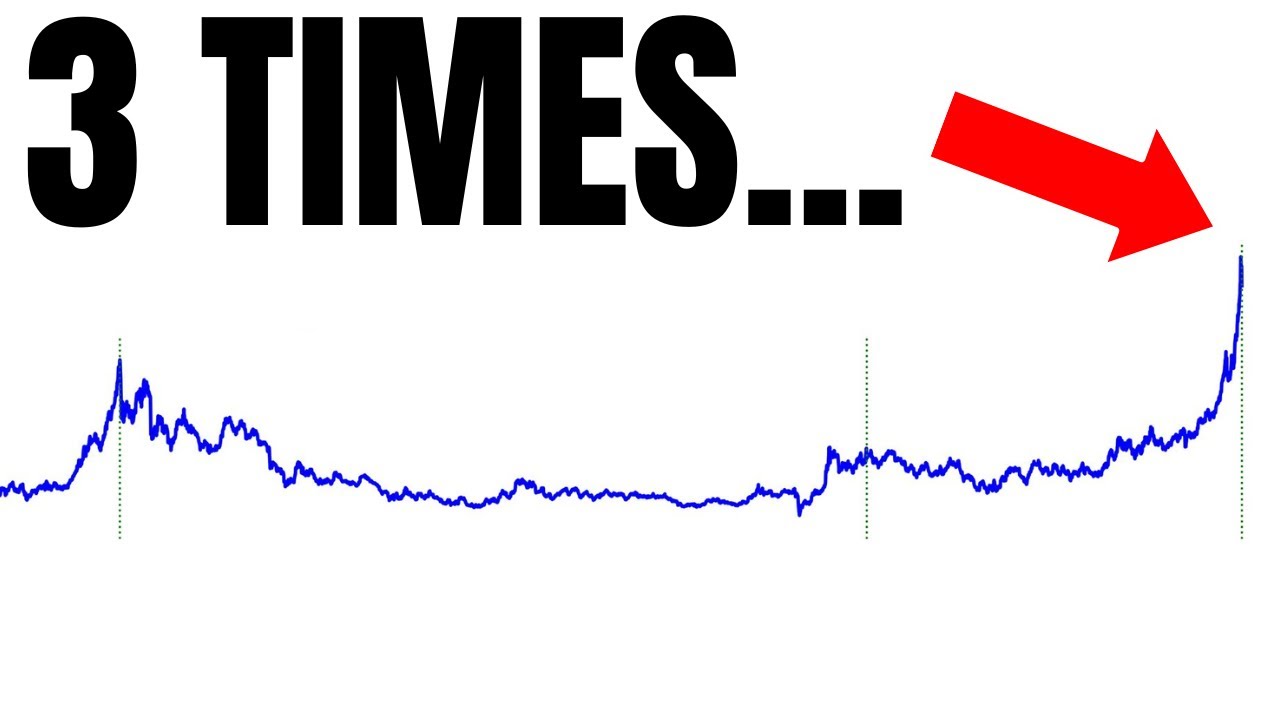

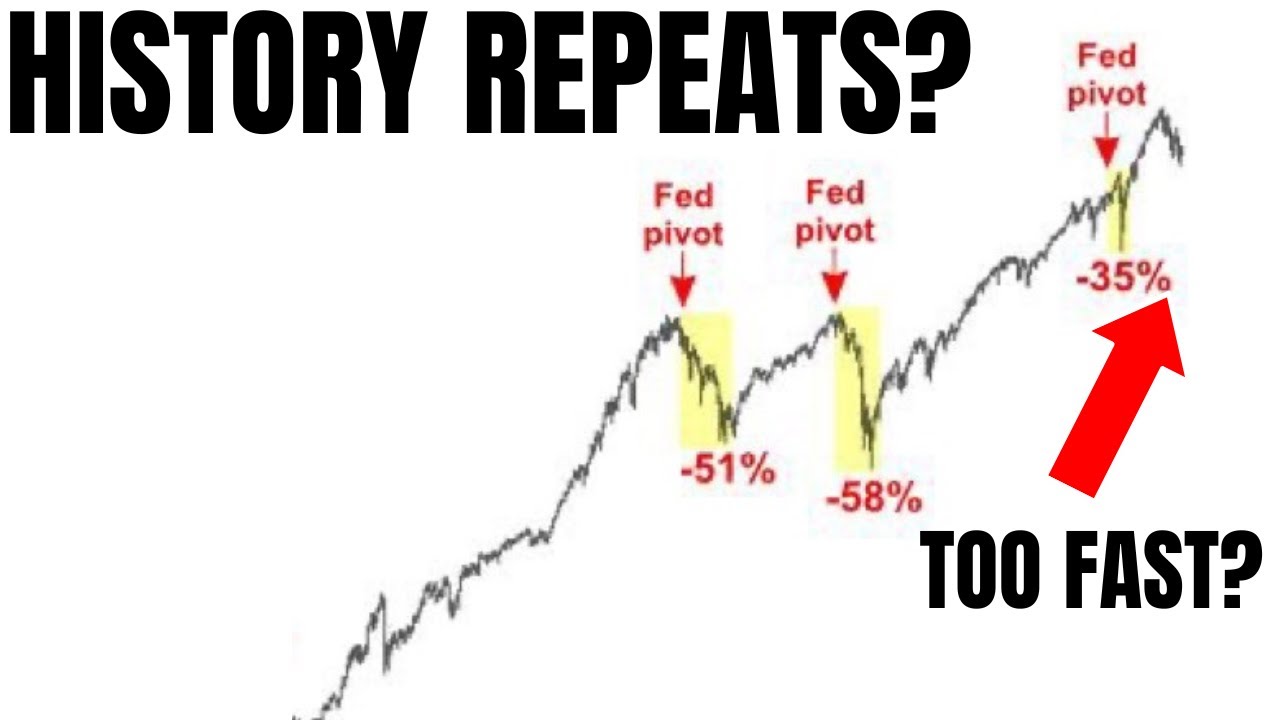

In this video, Thomas Atinson discusses the implications of potential interest rate cuts by the Federal Reserve and their historical context, addressing concerns about market volatility and economic stability. He also explores recent market movements in commodities and cryptocurrencies, providing insights into trading strategies and areas of caution for investors.

19:32

19:32| Metric | Observed | Expected |

|---|---|---|

| Views | 40,031 | 46,619 |

| Likes | 2,083 | 2,225 |

In this video, Thomas Atkinson delves into the implications of the Federal Reserve's massive liquidity program on the market, exploring trends in small caps, commodities like gold and silver, and the potential risks surrounding Bitcoin in midterm years. He unpacks significant market movements, including the S&P 500 reaching an all-time high, and shares insights on investor sentiment as they navigate this complex economic landscape.

26:01

26:01| Metric | Observed | Expected |

|---|---|---|

| Views | 48,475 | 46,619 |

| Likes | 2,266 | 2,225 |

In this video, Thomas Atinson discusses the latest market movements influenced by the Jolt's job quits report and its implications for potential Federal Reserve rate cuts. He also covers key updates on Nvidia's AI chip shipments, the silver market's remarkable rise, and insights into Bitcoin and other assets, while encouraging investors to stay informed amid evolving trends.

21:47

21:47| Metric | Observed | Expected |

|---|---|---|

| Views | 44,841 | 46,619 |

| Likes | 2,182 | 2,225 |

In this video, Thomas Atinson discusses the anticipated Federal Reserve rate cut, exploring its implications for various markets, including stocks, commodities, and Bitcoin. He dives into current market trends, liquidity signals, and the evolving landscape of investment, encouraging viewers to engage with the insights shared to navigate the upcoming shifts effectively.

28:51

28:51| Metric | Observed | Expected |

|---|---|---|

| Views | 52,698 | 46,619 |

| Likes | 2,303 | 2,225 |

In this special weekend edition, Thomas Atinson highlights the rare simultaneous rally in technology and transportation stocks over the past ten sessions, raising questions about the future of market dynamics amidst rising unemployment and potential Fed rate cuts. The video delves into various market trends, including cash burn in AI companies, sector performances, and the implications for investors as they navigate through this volatile landscape.

22:04

22:04| Metric | Observed | Expected |

|---|---|---|

| Views | 42,952 | 46,619 |

| Likes | 2,487 | 2,225 |

In this video, Thomas Atinson discusses the recent surge in debt concerns surrounding Oracle, the implications for the Federal Reserve, and the re-emergence of bullish signals in the Bitcoin and S&P 500 markets. Viewers will gain insights into current market trends, potential volatility, and how changes in macroeconomic conditions may impact investment strategies as we approach 2026.

20:37

20:37| Metric | Observed | Expected |

|---|---|---|

| Views | 45,206 | 46,619 |

| Likes | 2,166 | 2,225 |

In this video, Thomas Atinson analyzes the troubling trend of consumer debt during Black Friday, revealing that a staggering 95% of shoppers financed their purchases on credit, which may signal weakness in the market. He shares insights on potential impacts on stocks, commodities, and cryptocurrencies while highlighting the importance of monitoring bond health as the landscape evolves towards 2026.

21:17

21:17| Metric | Observed | Expected |

|---|---|---|

| Views | 48,777 | 45,201 |

| Likes | 2,326 | 2,303 |

In this video, Thomas Atinson examines the current challenges facing MicroStrategy, which is trading below its Bitcoin holdings, and the implications for the cryptocurrency market. He also discusses recent liquidity injections by the Federal Reserve, the movement in bonds, and what these factors might indicate for investors and traders in the coming months.

29:07

29:07In this video, Thomas Atinson discusses the current state of the markets, including the volatility in stocks, cryptocurrencies, and commodities, while highlighting the implications of recent financial trends and macroeconomic factors. He analyzes key levels and indicators to assess future market movements, emphasizing the importance of careful observation and risk management.

18:36

18:36In this video, Thomas Atinson analyzes recent market movements, discussing the implications of Wall Street's shift towards value funds and the performance of various sectors as we approach the end of the year. He highlights critical resistance levels for the NASDAQ, potential bullish trends, and the significance of upcoming market indicators, all while urging viewers to maintain a long-term perspective on their trading strategies.

20:49

20:49In this video, Thomas Atinson discusses the alarming rise in bond spreads, particularly around tech giants like Nvidia and Oracle, amidst concerns about capital expenditure in the tech sector. As Wall Street navigates these financial tensions and a changing market landscape, he highlights potential investment opportunities and the ongoing impact of AI advancements from competitors like Google.

27:20

27:20In this insightful market update, Thomas Atinson discusses the current state of key financial markets, highlighting concerns over leverage and cash allocations. The video also delves into significant trends in stocks, commodities, and cryptocurrencies, providing viewers with essential analysis before December's inflow period.