🔴 URGENT: Silver Price EXPLAINED! This Is What’s Going To Happen NEXT

PT30M21S

PT30M21S PT30M21S

PT30M21S PT20M55S

PT20M55S| Metric | Observed | Expected |

|---|---|---|

| Views | 19,622 | 13,894 |

| Likes | 1,440 | 987 |

PT15M28S

PT15M28S| Metric | Observed | Expected |

|---|---|---|

| Views | 25,566 | 14,247 |

| Likes | 1,661 | 997 |

PT11M56S

PT11M56S| Metric | Observed | Expected |

|---|---|---|

| Views | 8,016 | 15,026 |

| Likes | 561 | 952 |

PT10M53S

PT10M53S| Metric | Observed | Expected |

|---|---|---|

| Views | 6,414 | 15,026 |

| Likes | 563 | 952 |

PT14M56S

PT14M56S| Metric | Observed | Expected |

|---|---|---|

| Views | 12,726 | 15,026 |

| Likes | 847 | 952 |

PT16M2S

PT16M2S| Metric | Observed | Expected |

|---|---|---|

| Views | 35,078 | 15,026 |

| Likes | 2,741 | 952 |

PT22M19S

PT22M19S| Metric | Observed | Expected |

|---|---|---|

| Views | 11,016 | 15,112 |

| Likes | 818 | 954 |

PT13M13S

PT13M13S| Metric | Observed | Expected |

|---|---|---|

| Views | 11,322 | 15,112 |

| Likes | 531 | 954 |

PT21M16S

PT21M16S| Metric | Observed | Expected |

|---|---|---|

| Views | 26,205 | 15,112 |

| Likes | 1,778 | 954 |

PT11M9S

PT11M9S| Metric | Observed | Expected |

|---|---|---|

| Views | 29,892 | 15,112 |

| Likes | 1,363 | 954 |

PT16M44S

PT16M44S| Metric | Observed | Expected |

|---|---|---|

| Views | 9,663 | 15,112 |

| Likes | 752 | 954 |

PT14M36S

PT14M36S| Metric | Observed | Expected |

|---|---|---|

| Views | 10,782 | 15,112 |

| Likes | 901 | 954 |

PT20M36S

PT20M36S| Metric | Observed | Expected |

|---|---|---|

| Views | 23,136 | 11,672 |

| Likes | 1,805 | 827 |

PT13M20S

PT13M20S| Metric | Observed | Expected |

|---|---|---|

| Views | 17,442 | 11,672 |

| Likes | 866 | 827 |

PT23M29S

PT23M29S| Metric | Observed | Expected |

|---|---|---|

| Views | 4,053 | 11,672 |

| Likes | 416 | 827 |

PT15M10S

PT15M10S| Metric | Observed | Expected |

|---|---|---|

| Views | 29,194 | 11,672 |

| Likes | 1,678 | 827 |

PT14M27S

PT14M27S| Metric | Observed | Expected |

|---|---|---|

| Views | 6,908 | 11,672 |

| Likes | 538 | 827 |

PT14M31S

PT14M31S| Metric | Observed | Expected |

|---|---|---|

| Views | 4,557 | 11,672 |

| Likes | 447 | 827 |

PT18M39S

PT18M39S| Metric | Observed | Expected |

|---|---|---|

| Views | 35,530 | 11,672 |

| Likes | 2,187 | 827 |

PT12M54S

PT12M54S| Metric | Observed | Expected |

|---|---|---|

| Views | 5,298 | 11,672 |

| Likes | 486 | 827 |

PT12M8S

PT12M8S| Metric | Observed | Expected |

|---|---|---|

| Views | 8,814 | 11,672 |

| Likes | 839 | 827 |

PT11M45S

PT11M45S| Metric | Observed | Expected |

|---|---|---|

| Views | 12,569 | 11,672 |

| Likes | 1,174 | 827 |

PT16M54S

PT16M54S| Metric | Observed | Expected |

|---|---|---|

| Views | 42,034 | 11,672 |

| Likes | 2,433 | 827 |

PT17M37S

PT17M37S| Metric | Observed | Expected |

|---|---|---|

| Views | 4,674 | 11,672 |

| Likes | 415 | 827 |

PT21M57S

PT21M57S| Metric | Observed | Expected |

|---|---|---|

| Views | 9,540 | 11,672 |

| Likes | 661 | 827 |

In this episode, host Ivan launches a 20‑ounce silver giveaway while interviewing Clem Chambers, CEO of Online Blockchain plc, to debate whether the recent silver price rally is approaching its peak. Chambers explains that silver’s rapid, FOMO‑driven surge has turned the market into a high‑volatility trading arena, contrasting it with gold’s steadier “war‑money” trajectory and warning viewers to treat the current spike as a bubble rather than a long‑term investment.

PT12M44S

PT12M44S| Metric | Observed | Expected |

|---|---|---|

| Views | 19,444 | 11,672 |

| Likes | 1,307 | 827 |

In this episode, host Ivan launches a 20‑ounce silver giveaway while interviewing Strategic Wealth Preservation’s Mark Yaxley about the explosive drivers behind silver’s move toward triple‑digit prices, including geopolitical tensions, the U.S. critical metals designation, and upcoming Basel III regulations that could force banks to hold more physical metal. The discussion also offers practical advice for investors—balancing gold, silver, and other precious metals, recognizing short‑squeeze dynamics, and preparing for potential market corrections.

PT23M2S

PT23M2S| Metric | Observed | Expected |

|---|---|---|

| Views | 22,548 | 11,672 |

| Likes | 1,483 | 827 |

In this episode, host Ivan announces a 20‑ounce silver giveaway and discusses with guest Carrie Stevenson the meteoric surge in silver prices, tightening supplies, and the looming threat of central‑bank collapses amid global inflation and geopolitical tension. They also share practical tips for everyday investors to safeguard wealth with silver and gold, including starter‑pack ideas and upcoming precious‑metal conferences.

PT29M57S

PT29M57S| Metric | Observed | Expected |

|---|---|---|

| Views | 25,030 | 11,672 |

| Likes | 1,595 | 827 |

Marc Faber joins the channel to explain why silver and gold have been soaring—citing industrial demand, geopolitical tension, and massive money‑printing—as he debates the likelihood of $100 silver prices this week and warns of a looming asset‑price bubble. The video also launches a 20‑ounce silver giveaway, inviting viewers to like, comment their price forecasts, and subscribe for a chance to win.

PT29M50S

PT29M50S| Metric | Observed | Expected |

|---|---|---|

| Views | 21,545 | 11,672 |

| Likes | 1,416 | 827 |

In this episode, host Ivan launches a 20‑ounce silver giveaway while interviewing Keith Weiner, CEO of Monetary Metals, who explains the rising co‑asis and backwardation in silver and gold markets, the impact of strategic‑mineral status and recent margin‑call changes, and the surge in institutional demand that could push silver toward $100 per ounce. They also discuss the risks of back‑liquidation, the hedging challenges miners and refiners face, and how Monetary Metals’ leasing program offers an alternative way to earn yields on precious metals.

PT22M10S

PT22M10S| Metric | Observed | Expected |

|---|---|---|

| Views | 14,119 | 11,672 |

| Likes | 1,259 | 827 |

.In this episode we launch a 20‑ounce silver giveaway and sit down with Endgame Investor Rafy Farber to dissect silver’s rapid climb from the $30‑$40 range to near $80, discuss the potential collapse of fiat systems, hyperinflation, and why precious metals may become essential safeguards. We also examine central‑bank bailouts, CBDCs, global instability, and urge viewers to start stacking gold and silver, follow the channel, and join the conversation on Instagram and X.

PT27M

PT27M| Metric | Observed | Expected |

|---|---|---|

| Views | 48,264 | 11,672 |

| Likes | 2,942 | 827 |

.Ivan hosts a special episode featuring Andy Schectman, CEO of Miles Franklin, where they launch a 20‑ounce silver giveaway and break down why many analysts expect silver to break the $100‑per‑ounce barrier soon. The conversation highlights massive central‑bank accumulation, record COMEX deliveries, margin hikes that squeeze leveraged longs, and the emerging view of silver as a strategic, scarce metal poised for a prolonged bull market.

PT32M7S

PT32M7S| Metric | Observed | Expected |

|---|---|---|

| Views | 12,833 | 11,672 |

| Likes | 801 | 827 |

.In this episode, the host kicks off a 20‑ounce silver giveaway and interviews BMG Group CEO Yavon Blashik about the geopolitical turmoil—from Venezuela’s crisis to BRICS gold accumulation—and its impact on silver and gold prices, including a prediction that gold could hit $5,000 per ounce by early 2026. Viewers also receive practical advice on investing in physical bullion and diversified precious‑metal mutual funds.

PT18M34S

PT18M34S| Metric | Observed | Expected |

|---|---|---|

| Views | 24,396 | 11,672 |

| Likes | 1,257 | 827 |

Host Ian launches a 20‑ounce silver giveaway while interviewing veteran trader Greg Weldon, who warns that soaring global debt, shifting geopolitics and potential Chinese export restrictions could trigger a massive silver price surge rather than a collapse. He explains the lasting impact of the post‑1971 debt boom, the current gold‑silver squeeze, and how investors can position themselves using ETFs, mining stocks, and his new trading boot‑camp.

PT21M29S

PT21M29S| Metric | Observed | Expected |

|---|---|---|

| Views | 39,654 | 11,672 |

| Likes | 2,771 | 827 |

Join the channel’s silver giveaway for a chance to win 20 oz of silver by liking, subscribing, and commenting your favorite silver type or 2026 price prediction, with the winner announced at the end of January. In this episode host Wall Street Bullion sits down with analyst Bo Pollney to break down historic market cycles, recent breakout charts, and the bullish thesis that silver could surge toward $300 by 2026, potentially entering four‑digit territory.

PT13M32S

PT13M32S| Metric | Observed | Expected |

|---|---|---|

| Views | 15,709 | 11,672 |

| Likes | 971 | 827 |

description.In this episode Ivan kicks off a 20‑ounce silver giveaway and interviews Larry McDonald of the Bear Traps Report, who breaks down how years of losses in long‑duration government bonds are fueling a massive migration into hard assets such as silver, gold and platinum and why the metal’s market value could keep climbing. They also examine current geopolitical dynamics that are lifting oil‑service stocks and advise investors to steer clear of the increasingly crowded Nasdaq‑100 as they head into 2026.

PT11M20S

PT11M20S| Metric | Observed | Expected |

|---|---|---|

| Views | 6,667 | 11,672 |

| Likes | 307 | 827 |

PT12M27S

PT12M27S| Metric | Observed | Expected |

|---|---|---|

| Views | 21,268 | 11,672 |

| Likes | 934 | 827 |

In this interview, Alan Corbani, head of mining at Portfol and portfolio manager at Mount Blue Finance, explains why the fundamentals—lower interest rates, quantitative easing, and strong mining profit margins—could drive silver toward $200 per ounce and gold toward $5,000 despite recent speculative spikes. He advises new investors to diversify through ETFs, mutual funds, or physical metals, allocating 10‑15% of their portfolio to precious metals while staying mindful of market consensus and the emerging opportunities in royalty and producer stocks.

PT16M7S

PT16M7S| Metric | Observed | Expected |

|---|---|---|

| Views | 30,622 | 11,672 |

| Likes | 1,256 | 827 |

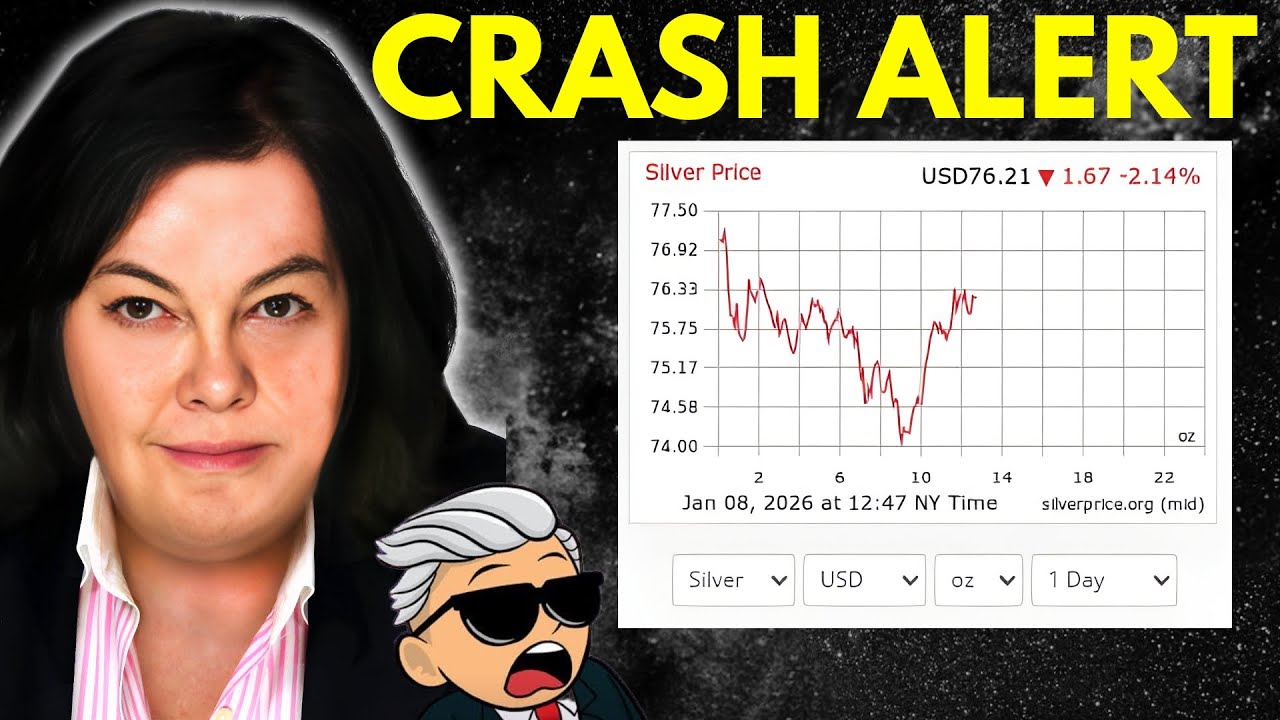

In this video, Lynette Zang, founder and CEO of Zang Enterprises, discusses the recent volatility in the silver market and highlights concerns over increased margin requirements affecting traders. She emphasizes the importance of investing in physical silver to safeguard against market fluctuations and shares her insights on potential price predictions and geopolitical risks leading into 2026.

PT17M26S

PT17M26S| Metric | Observed | Expected |

|---|---|---|

| Views | 8,270 | 11,672 |

| Likes | 518 | 827 |

In this urgent video, precious metals expert Bart Brands discusses the recent volatility in silver prices and the potential for market manipulation to unravel, emphasizing the importance of positioning oneself in gold and silver amidst changing monetary rules. He warns against herd mentality in investing, encouraging viewers to prioritize understanding the fundamentals of precious metals as they navigate the evolving financial landscape.