The Canada-China Trade Deal

PT18M4S

PT18M4S| Metric | Observed | Expected |

|---|---|---|

| Views | 209,934 | 214,365.5 |

| Likes | 6,899 | 8,692.5 |

PT18M4S

PT18M4S| Metric | Observed | Expected |

|---|---|---|

| Views | 209,934 | 214,365.5 |

| Likes | 6,899 | 8,692.5 |

PT17M54S

PT17M54S| Metric | Observed | Expected |

|---|---|---|

| Views | 194,622 | 214,529 |

| Likes | 7,863 | 8,695 |

In this video Richard breaks down the U.S. Delta Force raid that removed Venezuela’s President Nicolás Maduro and the subsequent claims that America will seize and develop the nation’s vast oil reserves, examining how realistic it is for U.S. firms to replace Canadian crude with Venezuelan heavy sour oil. He explains the infrastructure, investment, and market challenges that make a swift substitution unlikely and highlights the broader geopolitical and economic implications for both Venezuela and Canada’s energy sector.

PT18M59S

PT18M59S| Metric | Observed | Expected |

|---|---|---|

| Views | 151,535 | 214,807 |

| Likes | 6,705 | 8,703 |

Join host Richard Coffin as he reflects on the significant financial events of 2025 during the annual Finance Rewind on The Plane Bagel. Packed with light-hearted commentary and insights, this video explores key happenings, trends, and challenges, while looking ahead to the opportunities of 2026, and includes a special thank you to sponsor Brilliant.

23:31

23:31| Metric | Observed | Expected |

|---|---|---|

| Views | 227,435 | 215,212 |

| Likes | 9,029 | 8,717.5 |

In this festive holiday special, an investment analyst dons a Santa costume to critique various finance-related TikToks, categorizing them into naughty and nice lists based on their financial advice. Join him for a blend of holiday cheer and valuable insights as he discusses the realities of investing amidst the seasonal spirit.

20:01

20:01| Metric | Observed | Expected |

|---|---|---|

| Views | 244,455 | 244,197 |

| Likes | 8,623 | 8,618 |

In this video, Richard from the Plain Bagel examines the recent turmoil surrounding Bitcoin Treasury companies, particularly focusing on the drastic decline in Strategy's stock and the speculation linking JPMorgan to these losses. He explores the implications of falling Bitcoin prices, the potential for liquidation of treasuries, and the spread of unfounded conspiracy theories blaming JPMorgan for the situation, shedding light on the complex dynamics of the cryptocurrency market and investor sentiment.

1:02:50

1:02:50Join us for the Live Birthday Q&A Stream #5, where Richard celebrates his birthday by engaging with viewers, answering questions on finance, and sharing insights from the past year. Tune in to enjoy some light-hearted conversation, personal updates, and a mix of finance-related topics while celebrating this special occasion!

22:23

22:23In this video, Richard explores the current state of the generative AI industry, discussing the potential bubble surrounding it as companies rapidly invest billions into AI technologies while struggling to achieve profitability. By examining the financial dynamics and market behaviors reminiscent of the dotcom bubble, he seeks to provide a balanced perspective on whether the AI sector is on the brink of a downturn or if it has sustainable growth potential.

17:54

17:54In this video, Richard explores the recent surge in gold prices and the buzz surrounding the so-called "debasement trade," suggesting that fears of economic and political instability are driving investors towards this precious metal. He delves into the historical significance of gold as a safe haven asset, examines the factors fueling its current rally, and critically analyzes whether this trend reflects a genuine shift in global financial stability or merely a market fad.

29:20

29:20Join investment analyst Richard Coffin as he celebrates the 10th installment of his TikTok Reaction series, diving into finance TikToks and offering constructive feedback on popular investment ideas. From discussing the implications of tech-heavy ETFs to examining the risks of leveraged investments and day trading strategies, Richard aims to educate viewers while critiquing viral financial content with a blend of humor and expertise.

15:28

15:28In this video, Richard discusses the common central bank practice of targeting a 2% inflation rate, exploring its arbitrary origins and the rationale behind maintaining this figure. He examines the pros and cons of this approach, the impact on the economy, and why despite its flaws, the 2% target has become a widely accepted norm among major economies.

17:56

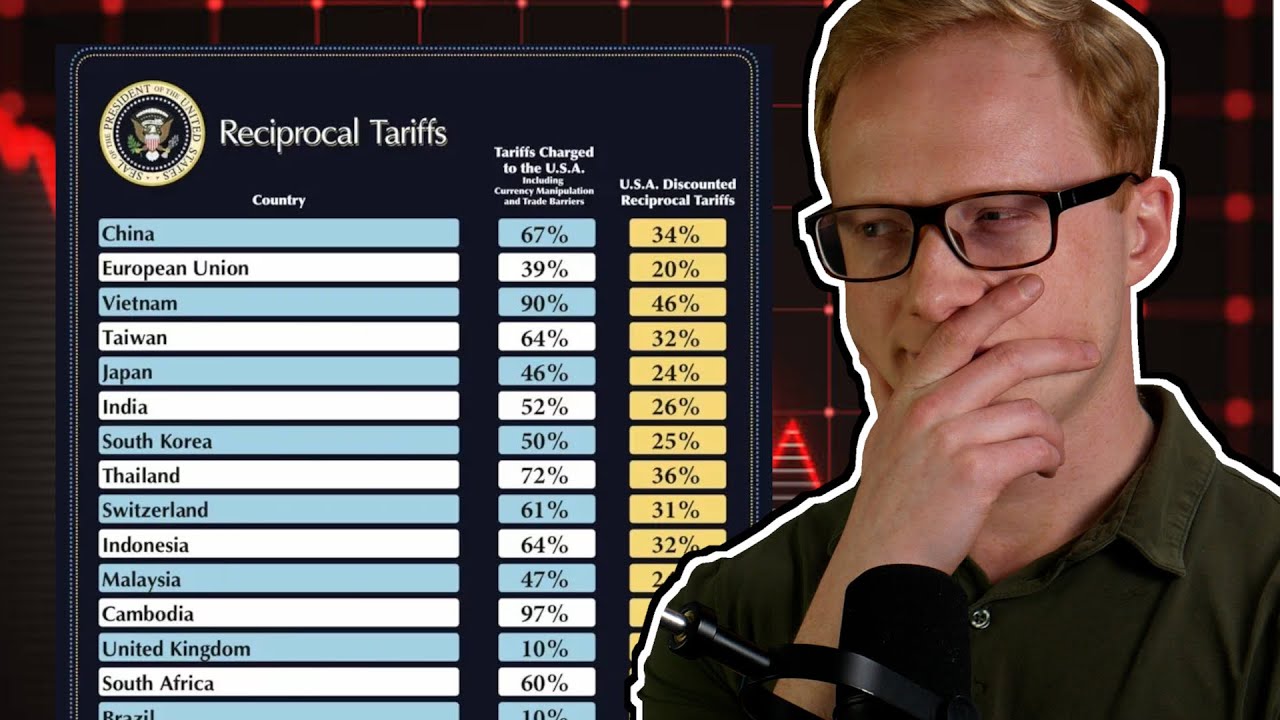

17:56In this video, Richard explores the effectiveness of Trump's tariffs, which have significantly increased the U.S. effective tariff rate to its highest level since 1935. He delves into the economic implications, examining how these tariffs have impacted consumer prices, manufacturing jobs, and overall economic growth, ultimately questioning whether the tariffs are genuinely benefiting the U.S. economy or merely distorting market conditions.

7:51

7:51In this video, the host exposes a scammer using AI to impersonate them and promote fake cryptocurrency investment opportunities on YouTube. They discuss the alarming rise of AI-generated scams, the importance of vigilance, and share tips to avoid falling victim to such fraudulent schemes.

9:56

9:56In this video, Richard debunks widespread misinformation regarding Federal Reserve Chair Jerome Powell's recent keynote speech, clarifying that the claims of abandoning the 2% inflation target are based on a severe misinterpretation. He emphasizes the importance of reading primary sources to avoid spreading misleading narratives that can influence investment decisions, highlighting the Fed's continued commitment to its inflation target amidst shifting economic dynamics.

16:11

16:11In this episode of Plain Bagel, Richard explores the rise of Bitcoin Treasuries, a strategy popularized by companies like Micro Strategy, which have opted to hold Bitcoin as a balance sheet asset, leading to significant stock price increases. He discusses the potential benefits and risks of this approach, including the intriguing notion of paying a premium for stock that effectively serves as a vehicle for Bitcoin exposure.

13:17

13:17In this video, Richard discusses the implications of the recent trade tariffs imposed on Canada by the U.S. following the failure to secure a deal by Donald Trump's deadline, highlighting how Canada has become one of the lowest tariff exporters to the U.S. despite the significant increases and exploring the potential impacts on Canada's economy and future trade relations. He also emphasizes the ongoing negotiations and the possibility for Canada to adapt and reduce dependency on U.S. trade through internal support measures and infrastructure development.

10:42

10:42In this video, Richard explains the monumental trade deal recently agreed upon between the United States and the European Union, marking a significant update in global trade dynamics with a new 15% tariff on EU exports to the US. He delves into the details of the agreement, including key concessions made by both sides and the implications for various industries, while highlighting the challenges ahead in finalizing and implementing the deal.

14:38

14:38In this video, Richard explores the implications of the recently passed Genius Act, which is the first significant national cryptocurrency legislation in the U.S., aimed at regulating stable coins and providing consumer protections in the crypto space. He also discusses upcoming legislation, including the Clarity Act, and analyzes the potential market impacts and criticisms surrounding these new regulations as the cryptocurrency landscape continues to evolve.

16:37

16:37In this video, Richard from The Plain Bagel explores the implications and complexities of Robinhood's recent launch of tokenized stocks, which allows users to invest in over 200 U.S. companies through cryptocurrency tokens. He discusses the potential benefits, risks, and legal controversies surrounding this innovative but controversial investment method, particularly regarding tokens representing private companies like OpenAI and SpaceX.

14:43

14:43In this video, Richard from The Plain Bagel examines the complex relationship between war and economic performance, detailing how wars can both stimulate certain sectors and devastate economies, especially in nations where conflict occurs. Through a review of extensive research on historical wars, he highlights that while some countries may experience temporary economic boosts, the general trend reveals significant long-term negative impacts on GDP, employment, and inflation.

16:01

16:01In this video, Richard from Plain Bagel discusses the implications of a proposed "revenge tax" aimed at foreign investors holding US investments, which could impose a withholding tax exceeding 20% on income from US stocks and other assets. He explores its potential effects on investors from countries like Canada, the UK, and Australia, as well as the broader impact on foreign investment in the US economy, urging viewers to stay informed as the legislation moves through the Senate.

20:08

20:08In this video, Richard Coffin discusses the rising alarm over US Treasury bonds, highlighting recent spikes in bond yields and the implications of a downgrade in the US credit rating. He aims to clarify the situation for viewers, providing a nuanced perspective on the risks involved while addressing the alarmist rhetoric circulating online.

13:32

13:32In this video, Richard Coffin discusses the recent developments in the US-China trade war, highlighting a tentative agreement reached in Geneva that involves reducing tariffs for a 90-day period. While markets reacted positively, he emphasizes the lack of concrete concessions from China and the ongoing complexities in trade relations, leaving the long-term implications of this deal uncertain.

23:42

23:42In this episode of Investment Analyst Reacts, Richard Coffin reviews various finance TikToks, highlighting the challenges investors face during turbulent economic times, including trade wars and stock market volatility. He emphasizes the importance of cautious investing strategies, like dollar cost averaging, while examining the pitfalls of oversimplified financial advice commonly found on social media.

14:28

14:28In this video, Richard from The Plain Bagel breaks down the complexities of the ongoing China-US trade war, highlighting recent tariff changes and their impacts on global stock markets and US Treasury yields. He explores potential motivations behind these economic decisions and the speculative landscape surrounding the trade relations between two of the world's largest economies, emphasizing the uncertainty and potential consequences for the global financial system.

17:35

17:35In this video, Richard from the Plain Bagel analyzes the recent tariff announcements by the Trump administration, which have led to significant declines in stock market performance, particularly a 10% drop in the S&P 500. He discusses the controversial methods behind the tariff calculations, the potential economic impacts, and why investors should remain cautious amidst the uncertainty of trade relations.

13:12

13:12In this video, Richard clarifies the misinformation surrounding Canada's tariff rates amid escalating trade tensions with the United States, particularly addressing exaggerated claims about dairy tariffs. He provides an overview of Canada's protectionist measures, supply management policies, and the actual effective tariff rates on imports, demonstrating that many commonly circulated figures are misleading or inaccurate.

18:22

18:22In this video, Richard explores Canada's internal trade barriers, highlighting how inefficient interprovincial trade can sometimes be hindered even more than trade with the U.S., leading to significant economic losses. He discusses potential solutions being proposed by provincial premiers to enhance self-sufficiency and reduce costs, emphasizing the urgency for reform amid ongoing U.S. trade tensions.

14:34

14:34In this video, Richard explores the implications of President Trump's executive order to establish a US Sovereign Wealth Fund, discussing its potential funding sources, objectives, and the challenges it faces. He examines how sovereign wealth funds operate globally, their historical contexts, and the significant concerns about the practicalities of implementing such a fund in the United States.

1:20:59

1:20:59In the inaugural episode of the new podcast series "Dead on the Money," hosts Richard Coffin and Derek Deadman explore personal finance fundamentals, addressing crucial topics like spending, debt, and investing while keeping the content beginner-friendly. By examining behavioral, cognitive, and systemic issues that contribute to financial struggles, they aim to demystify money management and help listeners improve their financial literacy.

21:31

21:31In this video, Richard breaks down the recent developments in the US-Canada trade tensions, focusing on President Trump's announced tariffs and their potential economic impact. He discusses the complexities surrounding these tariffs, the controversial reasons behind them, and the implications for both countries' economies moving forward, while aiming to foster a constructive dialogue on the topic.

5:39

5:39In this special announcement video, Richard from The Plain Bagel celebrates the milestone of reaching 1 million subscribers, expressing his gratitude for the support over the past seven years. He also introduces a new podcast series titled "Dead on the Money," which will focus on personal finance, alongside his continued commitment to educational content on the channel.

20:46

20:46Join investment analyst Richard in this holiday special as he reviews trending finance TikToks, discussing topics like Bitcoin's rise, modern monetary theory, and investing strategies for beginners. With a festive backdrop and insightful commentary, Richard aims to demystify financial concepts and help viewers navigate the often chaotic world of social media finance trends.

15:19

15:19Join us as we rewind through the pivotal moments of 2024, a year marked by significant developments in finance, including the rise of cryptocurrency, the approval of Bitcoin ETFs, and the election of Donald Trump. This video captures key events and themes that shaped the year, providing insights into what to expect as we head into 2025.

20:31

20:31This video explores the troubling trend of YouTubers promoting risky stocks for hefty payments, often obscuring the details of these sponsorships from their viewers. Through a thorough analysis of over 123 videos, the creator reveals concerning commonalities among the promoted firms, including their precarious financial health and the potential for misleading marketing practices in the finance space.

16:52

16:52In this episode of "Investment Analyst Watches Obscure Finance Films," Richard Coffin reviews the 1993 movie "Barbarians at the Gate," which chronicles the dramatic leveraged buyout of RJR Nabisco. Delving into the film's plot and financial jargon, Richard provides insightful context about corporate greed and the high-stakes world of Wall Street during the 1980s.

1:05:35

1:05:35Join us for the fourth annual birthday Q&A live stream, where the host answers questions from viewers while reflecting on personal anecdotes and channel milestones. This fun, casual event blends birthday celebrations with financial insights, allowing fans to engage directly with the host in a relaxed atmosphere.

16:21

16:21In this video, Richard Coffin discusses the recent approval of FTX's plan to refund its customers 118% of their account balances following the company's massive collapse nearly two years ago. With 98% of customers expected to receive their funds back by year-end, the update highlights both the successful asset recovery efforts of FTX's management and the ongoing questions surrounding the company's insolvency at the time of its bankruptcy.

12:48

12:48In this video, Richard Coffin provides an in-depth analysis of the recent surge in Chinese stocks, highlighting the strong market performance following government stimulus measures aimed at reviving the struggling economy and addressing the property crisis. He discusses the implications of these developments for investors, while also cautioning about the potential risks and volatility inherent in the Chinese stock market.

17:34

17:34In this video, Richard revisits the idea that meme stocks, particularly GameStop, are unlikely to make investors rich, despite lingering beliefs in a potential unprecedented short squeeze. He emphasizes the importance of prudent investing and the dangers of following unfounded narratives in the stock market, urging viewers to focus on sustainable investment strategies rather than relying on speculative hype.

18:56

18:56In this video, Richard Coffin explores the contentious world of private equity, examining its significant financial influence, controversial practices, and the public's growing disdain for the industry. He delves into the impacts of private equity on employment, healthcare, and consumer services while questioning the long-term sustainability of its aggressive investment strategies.