BIG 401(k) Changes Coming in 2026 — What You Need To Know

PT8M22S

PT8M22S PT8M22S

PT8M22S PT14M47S

PT14M47S| Metric | Observed | Expected |

|---|---|---|

| Views | 17,417 | 15,596 |

| Likes | 333 | 427 |

PT8M55S

PT8M55S| Metric | Observed | Expected |

|---|---|---|

| Views | 84,602 | 15,596 |

| Likes | 1,774 | 427 |

PT5M59S

PT5M59S| Metric | Observed | Expected |

|---|---|---|

| Views | 8,309 | 18,160.5 |

| Likes | 223 | 445 |

PT8M29S

PT8M29S| Metric | Observed | Expected |

|---|---|---|

| Views | 12,114 | 18,160.5 |

| Likes | 297 | 445 |

PT6M56S

PT6M56S| Metric | Observed | Expected |

|---|---|---|

| Views | 9,692 | 18,160.5 |

| Likes | 287 | 445 |

PT7M32S

PT7M32S| Metric | Observed | Expected |

|---|---|---|

| Views | 4,620 | 18,160.5 |

| Likes | 132 | 445 |

PT9M48S

PT9M48S| Metric | Observed | Expected |

|---|---|---|

| Views | 22,989 | 18,160.5 |

| Likes | 489 | 445 |

PT9M29S

PT9M29S| Metric | Observed | Expected |

|---|---|---|

| Views | 21,415 | 18,160.5 |

| Likes | 630 | 445 |

PT11M18S

PT11M18S| Metric | Observed | Expected |

|---|---|---|

| Views | 53,758 | 47,354 |

| Likes | 817 | 898 |

PT9M56S

PT9M56S| Metric | Observed | Expected |

|---|---|---|

| Views | 11,225 | 47,354 |

| Likes | 247 | 898 |

PT7M35S

PT7M35S| Metric | Observed | Expected |

|---|---|---|

| Views | 10,480 | 47,354 |

| Likes | 290 | 898 |

PT10M6S

PT10M6S| Metric | Observed | Expected |

|---|---|---|

| Views | 9,076 | 47,354 |

| Likes | 231 | 898 |

PT7M9S

PT7M9S| Metric | Observed | Expected |

|---|---|---|

| Views | 44,087 | 47,354 |

| Likes | 896 | 898 |

PT9M20S

PT9M20S| Metric | Observed | Expected |

|---|---|---|

| Views | 33,608 | 47,354 |

| Likes | 596 | 898 |

PT8M39S

PT8M39S| Metric | Observed | Expected |

|---|---|---|

| Views | 39,829 | 47,354 |

| Likes | 641 | 898 |

PT7M32S

PT7M32S| Metric | Observed | Expected |

|---|---|---|

| Views | 112,089 | 47,354 |

| Likes | 1,416 | 898 |

PT7M58S

PT7M58S| Metric | Observed | Expected |

|---|---|---|

| Views | 14,883 | 47,354 |

| Likes | 341 | 898 |

PT14M17S

PT14M17S| Metric | Observed | Expected |

|---|---|---|

| Views | 13,978 | 47,354 |

| Likes | 288 | 898 |

In this episode the hosts break down Consumer Affairs’ study that ranks every state by how many years it would take to save a 10 % down‑payment on a median home—showing the fastest states (Iowa, Ohio, Texas) still need 8‑10 years, while places like California, New York and Montana can require 23‑25 years. They then reveal a more aggressive “3525” strategy—using a 3 % down‑payment, keeping housing costs under 25 % of gross income, and leveraging their home‑buying calculator—to cut those timelines dramatically and give viewers a realistic path to ownership.

PT15M4S

PT15M4S| Metric | Observed | Expected |

|---|---|---|

| Views | 25,092 | 47,354 |

| Likes | 520 | 898 |

The video critiques the Economic Policy Institute’s outrageous “comfortable” income estimates—$107,000 for a single adult, soaring to nearly $500,000 for a family of five in California—and explains why those figures are unrealistic for most Americans. It then shows how you can define comfort on your own terms by living within your means, using the two levers of increasing income or cutting expenses, and applying practical rules for car and home purchases to build a stable financial foundation.

PT7M40S

PT7M40S| Metric | Observed | Expected |

|---|---|---|

| Views | 9,434 | 47,354 |

| Likes | 280 | 898 |

The video reveals how even savvy investors can sabotage their wealth by letting emotions drive decisions—missing just a handful of the market’s best days can slash decades‑long gains dramatically—and explains why growing financial complexity, time constraints, and high‑stakes choices make self‑management risky. It then outlines three clear moments when hiring a professional advisor is essential, urging viewers to recognize these signals and seek help before their “good” habits turn into hidden financial pitfalls.

PT7M16S

PT7M16S| Metric | Observed | Expected |

|---|---|---|

| Views | 6,622 | 47,354 |

| Likes | 155 | 898 |

.Chasing trendy “next big things” like cryptocurrency or trying to pick the next Nvidia often backfires, wasting both money and time while exposing investors to needless volatility and speculation. Instead, the video advises building wealth through simple, low‑cost diversification—using broad market index funds and automatically rebalancing target‑date funds that become more conservative as you near retirement.

PT6M49S

PT6M49S| Metric | Observed | Expected |

|---|---|---|

| Views | 8,050 | 47,354 |

| Likes | 241 | 898 |

Waiting a decade to start saving and investing turns the path to a million dollars into roughly four times the monthly effort—$95 a month at 20 versus $340 at 30—because compounding power dramatically diminishes over time. The video explains why the earliest you can responsibly begin matters, then outlines a nine‑step financial order of operations to build a solid foundation (insurance, emergency fund, debt reduction, employer matches) before leveraging those savings for growth.

PT15M49S

PT15M49S| Metric | Observed | Expected |

|---|---|---|

| Views | 11,740 | 47,354 |

| Likes | 284 | 898 |

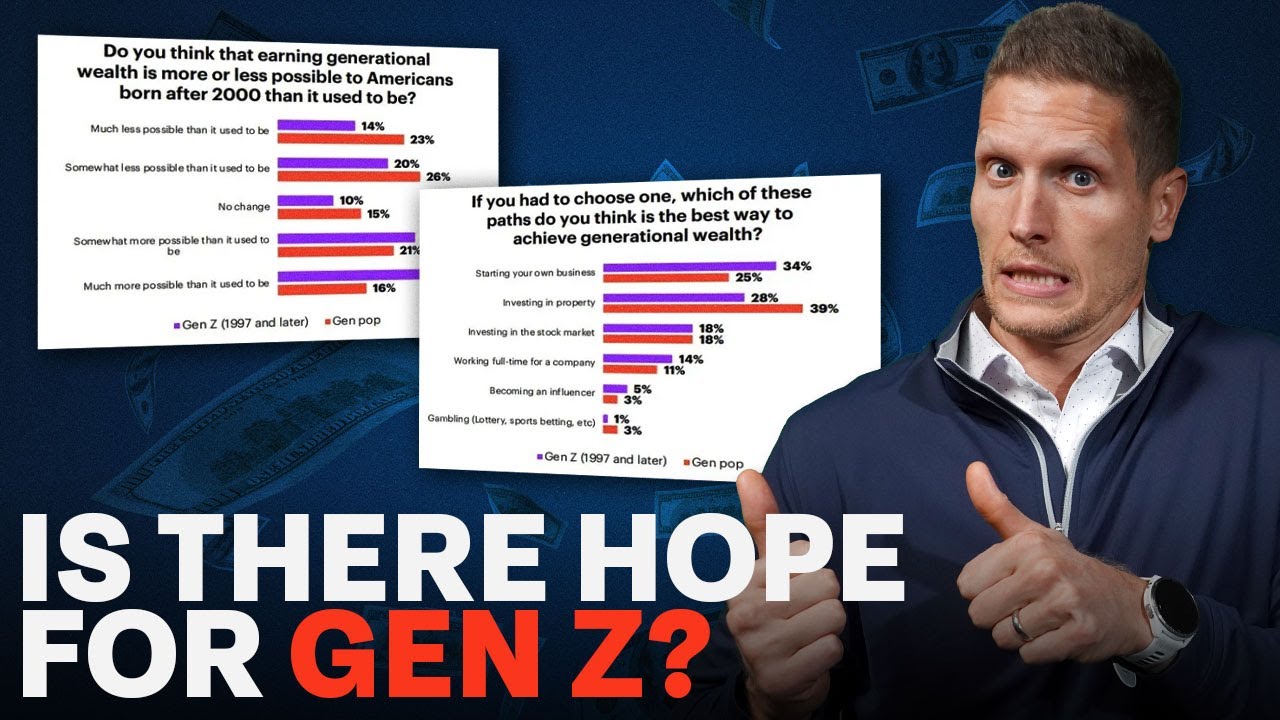

Based on a recent Yuggov survey, Gen Z overwhelmingly believes building generational wealth is more attainable than ever—25% say it’s somewhat more possible and 30% say it’s much more possible—while older generations remain skeptical. The hosts explain why this optimism is tied to technology‑driven opportunities such as entrepreneurship, real‑estate investing, and accessible stock‑market investing, and offer practical steps for young people to start building wealth now.

PT8M21S

PT8M21S| Metric | Observed | Expected |

|---|---|---|

| Views | 17,165 | 47,354 |

| Likes | 549 | 898 |

.This video breaks down how Bitcoin, gold, and stocks differ in what gives them value—Bitcoin’s scarcity and network adoption, gold’s physical limited supply, and stocks’ earnings‑driven cash flow—and explains the distinct risks each faces, from Bitcoin’s extreme price swings to gold’s modest long‑term returns and storage costs, to the business‑failure risk inherent in equities. It concludes that while a small allocation to digital or precious‑metal assets can add diversification, most investors are better served by low‑cost index or target‑date funds that capture the steady, dividend‑and‑growth‑based gains of the broader market.

PT9M8S

PT9M8S| Metric | Observed | Expected |

|---|---|---|

| Views | 19,702 | 47,354 |

| Likes | 432 | 898 |

.Only 14 % of Americans with a 401(k) actually max out their contributions, yet a household earning about $128 K can fully fund both a $7,500 Roth IRA and a $24,500 401(k) by saving just 25 % of gross income, unlocking powerful tax‑advantaged growth and protecting against lifestyle inflation. This video explains why maxing out retirement accounts is a disciplined, high‑impact step in the financial order of operations and shows how you can leverage employer matches, after‑tax contributions, and a 25 % savings rate to secure greater flexibility and a stronger retirement future.

PT6M30S

PT6M30S| Metric | Observed | Expected |

|---|---|---|

| Views | 6,638 | 47,354 |

| Likes | 222 | 898 |

These experts walk you through step four of the financial order of operations—building an emergency fund—explaining why 54 % of Americans lack three months of living expenses and how a tailored three‑ or six‑month cash reserve acts as a safety net that prevents desperate decisions during job loss or other crises. They also preview the next step, showing how tax‑free vehicles like Roth IRAs and HSAs can supercharge wealth once your safety net is in place.

PT8M15S

PT8M15S| Metric | Observed | Expected |

|---|---|---|

| Views | 9,060 | 47,354 |

| Likes | 223 | 898 |

.In this video the host breaks down the three most common pitfalls that keep people from investing: failing to secure enough cash to cover their highest insurance deductible, neglecting to capture free money through their employer’s 401(k) match, and allowing high‑interest debt to erode their wealth‑building power. By following a simple financial order of operations—first fund a high‑yield emergency buffer, then lock in the employer match, and finally eliminate costly debt—viewers learn how to turn cash into a productive asset and set the foundation for long‑term investing.

PT26M43S

PT26M43S| Metric | Observed | Expected |

|---|---|---|

| Views | 57,951 | 47,354 |

| Likes | 1,327 | 898 |

In this video, Brian and Mr. B break down the five biggest rookie investing mistakes—waiting too long to start, jumping in before securing an emergency fund and insurance, chasing trendy assets like crypto, choosing the wrong accounts or platform, and ignoring professional guidance—while showing how compounding, a solid financial order of operations, and simple index‑fund strategies can protect and grow your wealth. They also reveal how a modest monthly contribution early on can dramatically reduce the effort needed to become a millionaire, and why asking for help at key life stages is essential for long‑term success.

PT11M54S

PT11M54S| Metric | Observed | Expected |

|---|---|---|

| Views | 20,183 | 47,354 |

| Likes | 513 | 898 |

Let's produce.The video reveals that Health Savings Accounts (HSAs) are the most underrated investment vehicle in America, delivering a “triple‑tax‑advantage” (deductible contributions, tax‑deferred growth, and tax‑free withdrawals for qualified medical expenses) with a possible fourth benefit when employer contributions also reduce payroll taxes. It explains eligibility requirements, 2026 contribution limits, common pitfalls, and actionable strategies—such as investing the balance, retaining receipts for future reimbursements, and leveraging HSAs for retirement tax planning—to help viewers unlock the full, under‑utilized power of this account.

PT10M26S

PT10M26S| Metric | Observed | Expected |

|---|---|---|

| Views | 44,352 | 47,354 |

| Likes | 1,168 | 898 |

In this video, we explore the troubling dynamics of the AI bubble, focusing on Nvidia's central role in the market and the financial concerns surrounding companies like OpenAI. We examine historical comparisons to the dot-com bubble, discuss investment strategies to safeguard your finances, and underscore the importance of diversification in uncertain times.

PT6M18S

PT6M18S| Metric | Observed | Expected |

|---|---|---|

| Views | 7,275 | 47,354 |

| Likes | 231 | 898 |

In this insightful video, we explore how your financial starting point does not dictate your future, emphasizing that anyone can change their financial trajectory through disciplined saving and investing. Discover the power of incremental progress, as even a modest savings plan can lead to significant wealth over time, illustrating that it's never too late to start building a prosperous future.

PT6M51S

PT6M51S| Metric | Observed | Expected |

|---|---|---|

| Views | 27,567 | 47,354 |

| Likes | 515 | 898 |

In this enlightening video, discover how mastering the habit of saving and disciplined spending can significantly impact your wealth-building journey, regardless of your income level. Learn valuable insights into the power of time and how even small, consistent savings can lead to financial freedom and a comfortable retirement.

PT5M1S

PT5M1S| Metric | Observed | Expected |

|---|---|---|

| Views | 8,456 | 47,354 |

| Likes | 197 | 898 |

In this insightful video, the hosts discuss why many high earners still find themselves living paycheck to paycheck, highlighting statistics that reveal a significant portion of those with incomes over $150,000 struggle to manage their finances. They argue that while money can cover basic needs, it does not inherently bring happiness, as financial discipline and personal values play crucial roles in achieving true financial well-being.

PT9M44S

PT9M44S| Metric | Observed | Expected |

|---|---|---|

| Views | 13,645 | 47,354 |

| Likes | 272 | 898 |

In this video, the hosts discuss investment strategies for a 39-year-old individual who has accumulated $740,000 in savings, with only $150,000 actively invested. They emphasize the importance of effectively utilizing cash reserves for long-term financial independence and suggest a systematic approach for investing the remaining funds to maximize growth potential.

PT6M12S

PT6M12S| Metric | Observed | Expected |

|---|---|---|

| Views | 21,577 | 47,354 |

| Likes | 673 | 898 |

In this video, discover actionable strategies to transform your finances and reach your first $100,000 by 2026, no matter your starting point. Learn how to effectively save, invest, and increase your income while understanding the vital role of compounding interest in building long-term wealth.

PT1H1M55S

PT1H1M55S| Metric | Observed | Expected |

|---|---|---|

| Views | 62,878 | 47,354 |

| Likes | 1,316 | 898 |

In this video, experts discuss the critical factors to consider when planning for early retirement, addressing common questions about investment strategies, withdrawal rates, and financial independence. They emphasize the importance of personalized planning and practical tools to ensure a secure retirement strategy that aligns with individual goals.

45:29

45:29| Metric | Observed | Expected |

|---|---|---|

| Views | 86,323 | 47,354 |

| Likes | 1,604 | 898 |

In "The Most Honest Conversation About Money You’ll Hear Today," a couple candidly discusses their differing priorities regarding saving for the future versus enjoying the moment with their children. The conversation highlights the emotional complexities surrounding finances in relationships, as they navigate the need for balance between investing in experiences today and securing a stable future.

8:42

8:42| Metric | Observed | Expected |

|---|---|---|

| Views | 13,144 | 47,354 |

| Likes | 265 | 898 |

In this insightful video, financial experts discuss the nuances of homeownership, emphasizing the importance of purchasing a home for financial independence while challenging the traditional 20% down payment rule. They introduce the 3525 rule, encouraging prospective buyers to carefully assess their needs and financial readiness before making the significant decision to invest in a home.

11:29

11:29| Metric | Observed | Expected |

|---|---|---|

| Views | 8,263 | 47,354 |

| Likes | 201 | 898 |

In this video, financial experts discuss the common belief that living a debt-free life is essential for success, arguing that this rule can be broken if debt is used responsibly with clear guidelines. They provide practical advice on managing different types of debt, emphasizing the importance of discipline and strategic decision-making to leverage debt as a financial tool rather than a burden.