BITCOIN WILL CRASH AGAIN!!! [watch within 24 hours]

![BITCOIN WILL CRASH AGAIN!!! [watch within 24 hours]](https://i.ytimg.com/vi/yTYSYyN1fsA/maxresdefault.jpg) PT7M24S

PT7M24S![BITCOIN WILL CRASH AGAIN!!! [watch within 24 hours]](https://i.ytimg.com/vi/yTYSYyN1fsA/maxresdefault.jpg) PT7M24S

PT7M24S PT10M48S

PT10M48S PT12M18S

PT12M18S PT9M51S

PT9M51S PT13M43S

PT13M43S PT10M23S

PT10M23S PT11M57S

PT11M57S PT11M48S

PT11M48S PT11M51S

PT11M51S PT10M27S

PT10M27S PT10M

PT10M PT9M27S

PT9M27S PT8M28S

PT8M28S PT9M46S

PT9M46S PT9M46S

PT9M46S PT7M19S

PT7M19S PT8M52S

PT8M52S PT9M27S

PT9M27S PT9M9S

PT9M9S PT10M5S

PT10M5S PT10M32S

PT10M32S PT9M16S

PT9M16S PT9M3S

PT9M3S PT11M13S

PT11M13S PT8M58S

PT8M58S PT9M23S

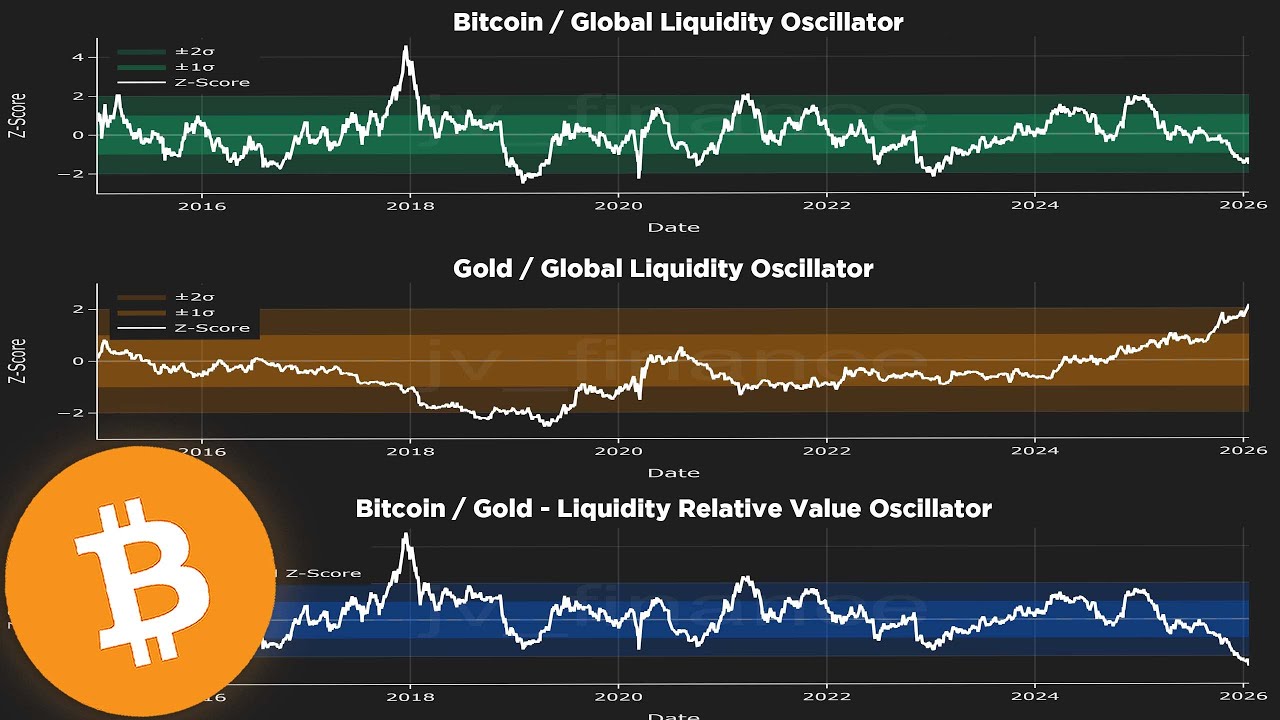

PT9M23SThe video explains how Bitcoin’s 2025‑2026 price action is mirroring the 2021‑2022 cycle, with identical double‑top/bottom formations, a retest of the 200‑day SMA, and major liquidity walls looming above and below the market. The presenter outlines his strategy to short the upcoming 200‑SMA retest while hedging long positions, and invites viewers to join his VIP Telegram group and use the WEX exchange for detailed trade signals.

PT10M8S

PT10M8SIn this update, the creator examines Bitcoin’s recent breakout above key resistance, the confirmation of an ascending triangle, and liquidity‑heat‑map zones that suggest price targets around $16,000‑$19,000 and a potential move toward the 200‑day moving average near $106,000. He outlines his short‑term trade plan, invites viewers to copy his positions via a VIP Telegram group with a USDT airdrop offer, and reminds the audience to like, subscribe, and stay tuned for future market analysis.

PT10M22S

PT10M22SIn this update, the creator analyzes Bitcoin’s breakout from a two‑month consolidation, forecasting a short‑term rally to around $16,000 (with a potential push toward $100,000) and outlining both long and short trade setups based on technical patterns, the four‑year cycle, and upcoming market volatility. The video also promotes a limited‑time VIP Telegram group where viewers can claim up to 2,200 USDT in bonuses, copy the creator’s trades, and learn about the Limitless prediction‑market airdrop.

PT8M33S

PT8M33SThe creator analyzes Bitcoin’s historic four‑year cycle, warning that a relief rally may be imminent around the 600‑700‑day mark after the last low and outlining the key breakout patterns, price targets, and liquidity conditions he’s watching to time trades. He also previews today’s crucial U.S. inflation release, explains why buying below $79,000 could be advantageous versus US ETFs, and urges viewers to like, subscribe, and join his trading groups for live trade signals.

PT9M12S

PT9M12SToday’s update breaks down Bitcoin’s sharp bounce off the $90,000 support box, analyzing the ascending‑triangle pattern, key resistance around $94.3 K with upside targets near $106‑110 K, downside zones around $70‑80 K, and the impact of the upcoming CPI data and recent dollar weakness on trade setups. I also share my short‑term trade plans, a $500 WEX signup bonus, and a VIP Telegram link for real‑time alerts—don’t forget to like, subscribe, and hit the bell for future insights.

PT8M12S

PT8M12SIn this update the creator breaks down how Bitcoin’s 2026 price action is eerily replicating the 2021‑2022 cycle—trading in a tight ascending‑triangle consolidation with major support near $74‑75 k (and Fibonacci‑based support around $83‑84 k), while weighing the odds of a breakdown versus a breakout that could trigger a relief rally to $16‑$26 k or a surge toward $106 k. He urges traders to stay flexible, check the WEX $500 bonus and VIP Telegram copy‑trading links in the description, and hit subscribe and the bell for alerts on the next big move.

PT7M45S

PT7M45S.In this update, the creator analyzes a historically flawless Bitcoin breakout signal, outlines the crucial support and resistance zones, and evaluates recent market turbulence sparked by the Supreme Court’s tariff ruling and a possible U.S. government shutdown that could trigger the next major price move. He also reveals his trading strategy—long positions if Bitcoin breaks higher, short positions near the $16‑$18 k range if it falls—and invites viewers to join his Telegram group for copy‑trading and live alerts.

PT7M1S

PT7M1S.The video warns that the next 24 hours will bring extreme crypto volatility as the U.S. Supreme Court’s tariff ruling and the upcoming employment report could trigger major market moves, while Bitcoin remains trapped in a tightening consolidation triangle within its 4‑year cycle. It also reviews technical charts, predicts a possible September‑October Bitcoin bottom, and promotes a WEX $500 lucky‑draw and a VIP Telegram group for live trade signals.

PT7M28S

PT7M28SIn this update, the host explains how Bitcoin has been rejected from the critical 2025‑yearly candle at the $93.5 K resistance, sliding toward the $84 K‑$70 K support zone and outlines his strategy to accumulate positions if the downtrend continues. He also warns that tomorrow’s Supreme Court ruling on Trump’s tariffs could trigger a massive market move—either a sharp rally if it favors Trump or a severe dump if it doesn’t—while promoting his WEX copy‑trading group and Telegram community.

PT7M30S

PT7M30S.In this update, the host examines Bitcoin’s current price action, highlighting an emerging ascending‑triangle pattern that could trigger a breakout toward $16,000 or a breakdown to around $70,000, while noting low open interest and the upcoming Supreme Court decision on Trump tariffs as additional volatility drivers. He also invites viewers to join his private Telegram group for copy‑trading signals and to claim a $50 USDT bonus via the WEX link in the description.

PT6M34S

PT6M34SBitcoin is retesting a pivotal resistance zone that aligns with the 2025 yearly open, the 0.382 Fibonacci level near $94,000 and the $100,000 psychological barrier, and the analyst warns that without a clear daily close above this zone the breakout remains uncertain, while a confirmed move could spark a relief rally toward the $18,000‑$106,000 range but also highlights the danger of dropping below the 100‑day moving average, which historically precedes a 50‑57% decline. The video also encourages viewers to like, subscribe, join the VP Telegram for copy‑trading, and claim a 50 USDT deposit bonus on WEX via the links in the description.

PT7M10S

PT7M10Stwo sentences.In this update the creator breaks down Bitcoin’s recurring New‑Year rally, highlighting the critical resistance zone around $93.5‑$98 K that has repeatedly caused rejections, outlining breakout scenarios that could propel the price toward $118 K (or higher) and outlining short‑trade opportunities if the rally stalls, while also reviewing similar patterns on Ethereum and on‑chain strength. He then promotes his private Telegram copy‑trading group, the WEX exchange (including a limited‑time New Year draw with prizes such as an iPhone 17 Pro), and encourages viewers to like, subscribe, and join the community for real‑time trade alerts.

PT7M56S

PT7M56S.In this update the creator breaks down Bitcoin’s recent breakout above a four‑week rejection level—triggered by news on Venezuela’s oil reserves—and outlines his technical outlook, including negative funding rates, a projected move toward $94 k and a longer‑term target near $110 k. He also forecasts a relief rally at the start of 2026, highlights key support zones, and invites viewers to join his private Telegram group and a limited‑time WEX promotion.

PT8M52S

PT8M52SIn this update, the creator examines Bitcoin’s recent dip below $90,000—triggered by heightened geopolitical tension from U.S. airstrikes in Venezuela—and analyzes key resistance and support zones, Federal Reserve liquidity injections, and potential breakout scenarios while tying them into longer‑term cycle forecasts. The video also highlights upcoming trades, a limited‑time giveaway (including an iPhone 17 Pro Max), and encourages viewers to like, subscribe, and join the associated Telegram community.

PT10M26S

PT10M26SIn this update, the creator examines Bitcoin’s current Fibonacci‑derived support and resistance levels, highlighting a tight $86,000‑$90,000 daily range and forecasting that a breakout—either upward toward the 0.618‑0.786 zones or downward toward the 0.382‑0.5 zones—could trigger the next major move, possibly setting a bottom around $55,000‑$72,000 by spring. He also notes historically low volatility as a breakout catalyst, promotes a limited‑time New Year draw and private Telegram group, and urges viewers to stay prepared for rapid price action.