The CRASH About to Happen Will Shock You- In a Few Weeks, You'll Wish You Hadn't Been so Complacent

PT34M7S

PT34M7S PT34M7S

PT34M7S PT30M19S

PT30M19S PT29M18S

PT29M18S PT33M9S

PT33M9S PT35M24S

PT35M24S PT32M28S

PT32M28S PT28M29S

PT28M29S PT21M59S

PT21M59S PT33M54S

PT33M54S PT33M1S

PT33M1S PT28M52S

PT28M52S PT27M43S

PT27M43S PT29M

PT29M PT28M55S

PT28M55S PT34M45S

PT34M45S PT30M2S

PT30M2S PT32M3S

PT32M3S PT25M22S

PT25M22S PT29M39S

PT29M39S PT34M34S

PT34M34S PT32M48S

PT32M48S PT25M20S

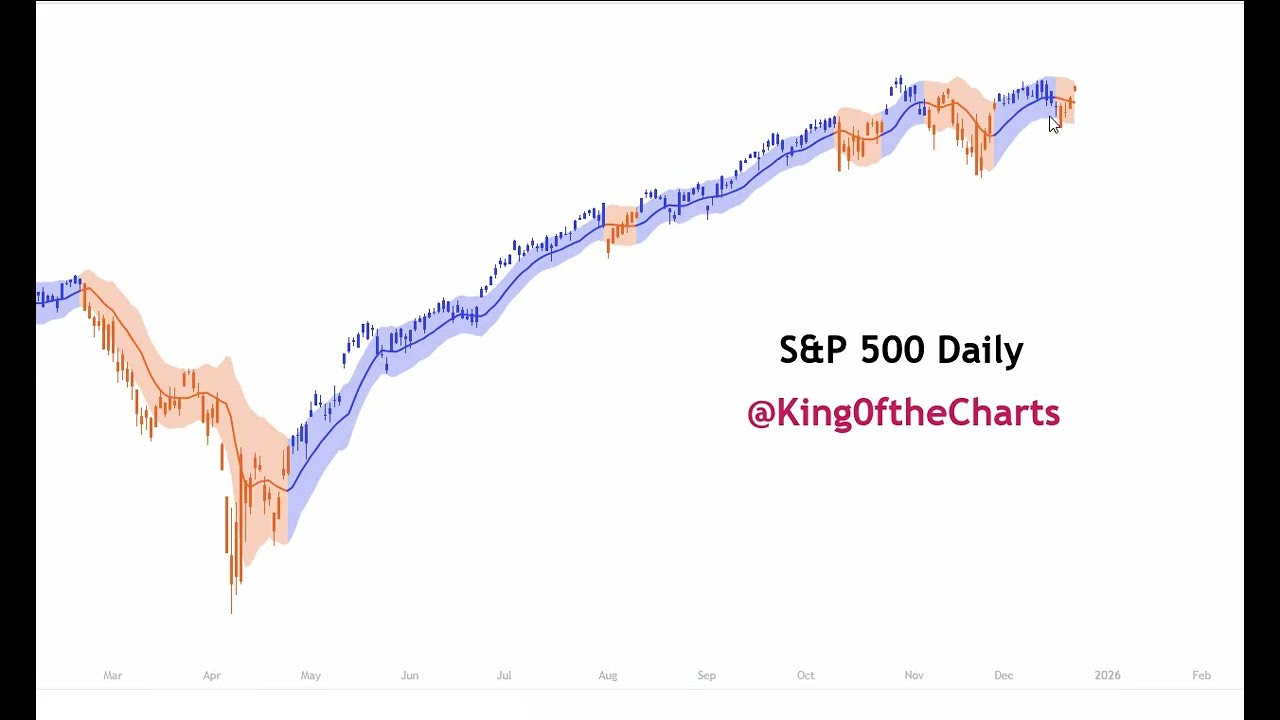

PT25M20SIn today’s market update the presenter notes that yesterday’s gap was filled, the S&P 500 and Nasdaq posted black candlesticks, and the Dow hovered just under the psychological 50,000‑point mark amid an AI rally led by Nvidia, AMD and TSMC. He then breaks down multiple technical signals—including rising‑wedge and head‑and‑shoulders formations, bearish divergences on the RSI, MACD and stochastic, and Bitcoin’s emerging bare‑flag—suggesting the indices could test the S&P 500’s 7,000 upper channel line while volatility (VIX) remains low.

PT32M20S

PT32M20SThe video analyzes the recent market sell‑off driven by banks such as Bank of America and Wells Fargo cutting credit, a jump in PPI inflation to 3% YoY, and lingering Supreme Court and geopolitical uncertainties that are pressuring the S&P 500, Nasdaq and other indices. It highlights technical signals—gap fills, rising‑wedge patterns, negative divergences on MACD/RSI, and debates over a credit‑card rate cap—that suggest the market may be nearing a tipping point, warning of a possible 20% drop and a looming banking‑credit crisis.

PT25M38S

PT25M38SThe video breaks down today’s market tumble—down 300‑400 points on the Dow, a climbing VIX, and mixed earnings—as investors await inflation reports, a Supreme Court ruling on Trump’s tariffs, and geopolitical tension in Iran that could spark further volatility. It also examines technical divergences across the Dow, S&P 500, Nasdaq and Russell, warning that a breach of key moving‑average thresholds could trigger a 20% + sell‑off.

PT28M3S

PT28M3SJerome Powell faces a DOJ criminal probe over alleged false statements about the Fed’s $1.9 billion renovation, while traders await Tuesday’s CPI, Wednesday’s PPI and a possible Supreme Court ruling on Trump’s tariffs that could jolt markets. The host then applies Dow Theory, highlighting a fresh one‑day divergence between the Dow and transport indices, rising‑wedge patterns in long‑term yields, and multiple technical divergences that may foreshadow a significant sell‑off.

PT28M31S

PT28M31SThe analyst explains that the S&P 500 is forming a rising‑wedge double‑top with multiple point divergences from the Nasdaq, mirroring the 2022 and 2025 market tops, and suggests a bearish reversal could be imminent as trend and momentum indicators turn negative. He also ties the pattern to Bitcoin’s recent double‑top, notes upcoming inflation and policy events, and warns that a break of key support (50‑day/200‑week averages) could trigger a 20%+ sell‑off and a broader bear market.

PT31M6S

PT31M6SWith a weak jobs report, a delayed Supreme Court ruling on Trump’s tariffs, and upcoming CPI and PPI inflation data, analysts warn that the market could react sharply—especially as the Fed is expected to hold rates steady and earnings season begins. Technical charts meanwhile show the S&P 500 and Nasdaq forming a rising‑wedge/bearish double‑top with triple divergences on RSI, MACD and price, suggesting a potential downside breakout that could trigger a broader crash if yields spike.

PT26M21S

PT26M21SIn this episode the host warns that the S&P 500 is likely to hit its weekly peak as the jobs report and a Supreme Court ruling on Trump’s tariffs loom, potentially spiking yields and forcing a market reversal. He breaks down the inverse head‑and‑shoulder patterns, multiple divergences across the S&P, Nasdaq and Bitcoin, and explains why the upcoming data could spark a sell‑off and the start of a new bear phase.

PT36M49S

PT36M49SIn this video the analyst breaks down multiple bullish‑to‑bearish divergences on the S&P 500, Nasdaq 100 and Bitcoin—pointing to topping‑tail candlesticks, rising‑wedge patterns and moving‑average crossovers that suggest a market top may be forming this week. He then explains how the Supreme Court’s upcoming Jan 9 ruling on President Trump’s tariffs could be the catalyst that spikes yields, triggers a rapid sell‑off and potentially ignites a stock‑market crash if declared unconstitutional.

PT32M27S

PT32M27SThe host argues that the S&P 500 is on track to complete a double‑top pattern and reach its final peak by January 9, echoing the breakout‑pullback‑new‑high sequence seen around Christmas 2022, as confirmed by rising‑wedge boundaries, RSI/MACD divergences, and a higher high despite a lower‑high Nasdaq. He links this potential top to broader market stress—including Bitcoin’s 36 % sell‑off, weak ADP and jobs reports, climbing long‑term Treasury yields, and the Fed’s emergency liquidity measures—suggesting a looming recession and heightened volatility ahead of upcoming CPI and PPI data.

PT30M58S

PT30M58SThe video analyzes weakening labor reports, rising 10‑ and 30‑year Treasury yields, and the Federal Reserve’s precarious position, arguing that these factors are mirroring the conditions that triggered the 2022 market crash. It then points out a double‑top formation on the S&P 500, accompanying VIX spikes and divergent technical indicators, warning that a similar bearish reversal could unfold if key trend lines and yield thresholds are breached.

PT30M25S

PT30M25SThe video breaks down weekly charts of the Russell 2000, S&P 500, Nasdaq and Bitcoin, pointing out multiple negative divergences—MACD roll‑overs, RSI and Awesome Oscillator red bars, and failed highs—that signal a potential market top around the day after Christmas. It warns that if these bearish cues confirm, a sharp pull‑back could create a once‑in‑a‑lifetime buying opportunity at the peak of the current bull market.

PT36M17S

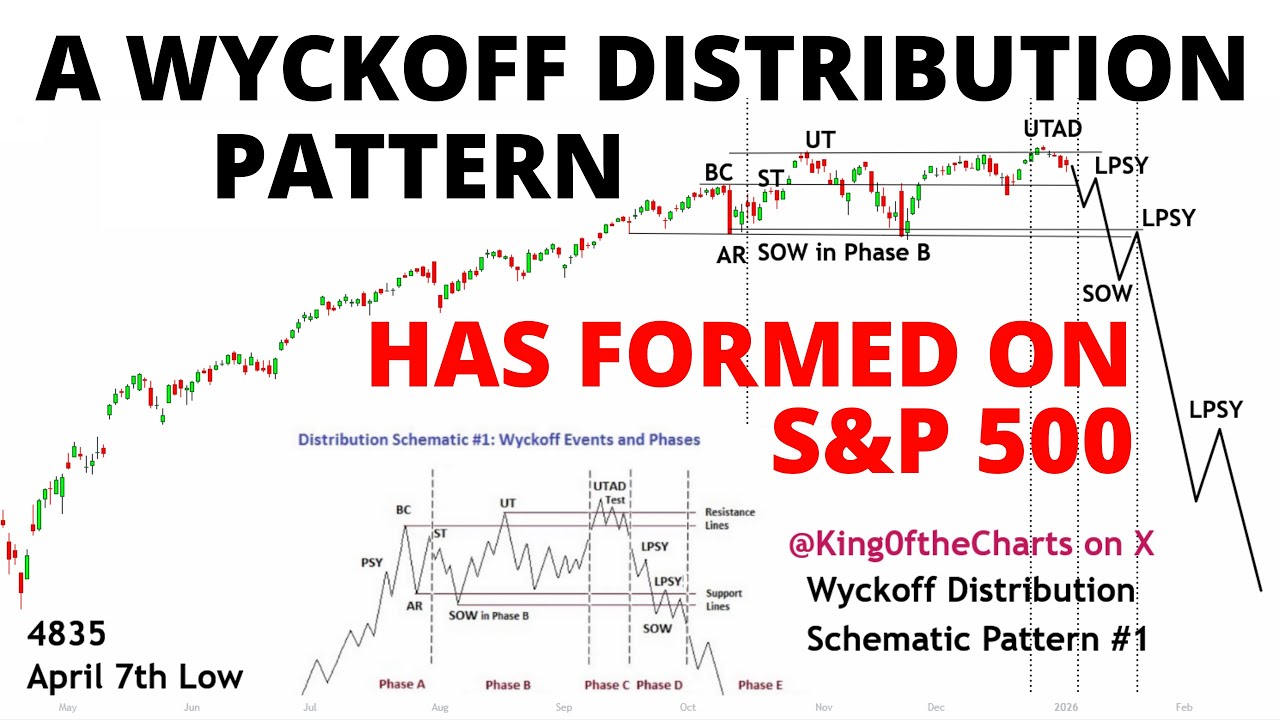

PT36M17SIn this update, the host dissects how the S&P 500 and Russell 2000 are mirroring Bitcoin’s Wyckoff distribution topping pattern, showcasing double‑top, lower‑high formations and index divergences that signal a classic distribution collapse. He warns that these signals point to a near‑term market peak, ties the outlook to upcoming private payroll and jobs data, and cautions that a Fed‑driven panic could trigger a sharp 20% sell‑off.

PT35M16S

PT35M16SIn this video, the analyst discusses the potential for the S&P 500 to complete a double top pattern, likely within the next week, as market indicators suggest a bearish trend is developing. With insights on Federal Reserve actions and divergences in key market sectors, viewers are encouraged to pay close attention to upcoming trading sessions as volatility and selling pressure may increase.

PT27M27S

PT27M27SIn this video, the analyst discusses a potential impending peak in the S&P 500 within the next eight trading sessions, drawing parallels to past market behavior in 2022. They suggest that this peak could lead to a significant market crash, indicated by a double top pattern formation and various divergences in the market indicators, hinting at a major sell-off ahead.

PT35M13S

PT35M13SIn this video, we analyze signals from the Awesome Oscillator indicating that the S&P 500 is likely to peak within the next nine trading sessions, potentially leading to a significant market crash reminiscent of previous downturns in 2022 and 2025. The discussion elaborates on the light volume breakout occurring during the holiday trading period and highlights the formation of negative divergences that could trigger a reversal in the near future.

PT34M36S

PT34M36SIn this video, the analyst shares insights on the potential for a stock market crash looming in the immediate future, drawing parallels to the 2022 scenario where key indices like the S&P 500 and NASDAQ diverged and ultimately collapsed after seeing short-term gains. They highlight current trends in economic data and market behavior that suggest a similar double top pattern is forming, warning viewers to prepare for possible downturns as we approach the new trading year.

PT33M35S

PT33M35SIn this analysis, the video discusses the potential repetition of the 2022 stock market crash, drawing parallels between current market conditions and those of late 2021 and early 2022. The presenter emphasizes key indicators, such as Bitcoin's volatility and market divergences, suggesting that a similar scenario of peaks and subsequent declines could unfold if certain conditions are met this holiday season.

PT26M2S

PT26M2SIn this video, we analyze the potential impacts of the Santa Claus rally on the S&P 500 while exploring bearish signals from Bitcoin and the NASDAQ. With critical resistance levels in play and the possibility of forming lower highs, we discuss implications for market direction as we approach year-end trading.

PT33M15S

PT33M15SIn this video, the speaker discusses potential triggers for an impending banking crisis, highlighting concerns about the Federal Reserve's interventions and the vulnerabilities of the banking system amid rising commercial real estate delinquencies. With bearish signals persisting in the stock market and increasing volatility expected, they emphasize the critical need to monitor these developments closely as recession warnings grow.