7 Things I Wish I Knew Before Day Trading

PT20M57S

PT20M57S PT20M57S

PT20M57S PT17M3S

PT17M3S| Metric | Observed | Expected |

|---|---|---|

| Views | 9,000 | 14,940 |

| Likes | 445 | 569 |

PT17M24S

PT17M24S| Metric | Observed | Expected |

|---|---|---|

| Views | 24,664 | 14,940 |

| Likes | 776 | 569 |

PT31M1S

PT31M1S| Metric | Observed | Expected |

|---|---|---|

| Views | 21,196 | 14,415 |

| Likes | 730 | 537 |

PT29M11S

PT29M11S| Metric | Observed | Expected |

|---|---|---|

| Views | 55,289 | 14,415 |

| Likes | 2,193 | 537 |

PT19M53S

PT19M53S| Metric | Observed | Expected |

|---|---|---|

| Views | 24,376 | 11,329.5 |

| Likes | 922 | 450 |

PT18M10S

PT18M10S| Metric | Observed | Expected |

|---|---|---|

| Views | 35,117 | 11,329.5 |

| Likes | 1,133 | 450 |

PT51M26S

PT51M26S| Metric | Observed | Expected |

|---|---|---|

| Views | 18,765 | 11,329.5 |

| Likes | 619 | 450 |

PT10M38S

PT10M38S| Metric | Observed | Expected |

|---|---|---|

| Views | 7,295 | 11,329.5 |

| Likes | 218 | 450 |

The video reveals that the biggest mistake traders make is treating any single indicator as a magic bullet instead of seeing it as just one data point within a broader, diversified trading playbook. It then demonstrates how to use indicators for context, filtering and outlier detection—paired with price action, fundamentals and multiple entry criteria—to avoid lagging, noisy signals and improve decision‑making.

PT21M52S

PT21M52S| Metric | Observed | Expected |

|---|---|---|

| Views | 49,289 | 11,329.5 |

| Likes | 1,749 | 450 |

In this video we walk through a high‑accuracy options‑trading system that combines Bollinger Bands and the RSI on the QQQ daily chart to spot extreme overbought or oversold conditions and predict mean‑reversion moves. We then show how to capitalize on those signals by placing 20‑delta call credit spreads for bearish setups and 20‑delta put credit spreads for bullish setups, demonstrating real‑world examples that achieve an exceptionally high win rate and strong risk‑adjusted returns.

PT56M22S

PT56M22S| Metric | Observed | Expected |

|---|---|---|

| Views | 14,491 | 11,329.5 |

| Likes | 437 | 450 |

In this video the traders unveil their #1 profit‑driving RSI‑based mean‑reversion short playbook, showcasing a massive silver (SLV) short that generated millions for the firm during the Christmas‑week market blow‑off. They walk through the custom RSI settings, complementary filters (Kelner channels, acceleration cues, and context checks), and the team‑based process that turns wildly overextended moves into high‑reward trades.

PT1H2M52S

PT1H2M52S PT23M34S

PT23M34S| Metric | Observed | Expected |

|---|---|---|

| Views | 55,280 | 14,604 |

| Likes | 2,022 | 518 |

.In this video the host unveils the “Market Memory Model,” a three‑step day‑two framework that marks yesterday’s high, low, and the most decisive price battle to create clean, repeatable trade setups. By respecting those remembered seller and buyer zones, avoiding the ambiguous middle, and watching for the distinctive “John Wick” candle, traders can trade calmly, consistently, and turn simple strategies into reliable profit machines.

PT40M25S

PT40M25S| Metric | Observed | Expected |

|---|---|---|

| Views | 32,129 | 14,645 |

| Likes | 1,003 | 521 |

In this video, we break down the top five reversal patterns that professional traders look for when making entry decisions, especially focusing on how to identify these patterns bar-by-bar. Join us as we analyze real tickers and share insights on recognizing key levels and market psychology to anticipate potential reversals before they happen.

PT1H15M2S

PT1H15M2S| Metric | Observed | Expected |

|---|---|---|

| Views | 26,605 | 14,657 |

| Likes | 779 | 521 |

In this episode of the Trading Floor podcast, host Garrett Dryen and co-host Tim Beldin are joined by Dave Mabe, a systematic day trader and founder of Mabkit, who shares vital insights on the importance of back testing in trading strategies. They discuss how creating a solid optimization process can differentiate successful traders from those who struggle, emphasizing that taking full ownership of one’s trading methodology is crucial for long-term success.

18:36

18:36| Metric | Observed | Expected |

|---|---|---|

| Views | 27,807 | 14,666 |

| Likes | 894 | 521 |

In this informative video, discover effective strategies for growing a small trading account through options income trading, focusing on the advantages of selling options instead of buying them. Learn the importance of risk management, journaling trades for insights, backtesting strategies, and compounding your gains to achieve consistent success in the options market.

23:46

23:46| Metric | Observed | Expected |

|---|---|---|

| Views | 15,429 | 14,666 |

| Likes | 572 | 521 |

In this video, we conduct a detailed bar-by-bar analysis of five straightforward and profitable trades, emphasizing clear and repeatable entry triggers without the guesswork. Additionally, we explore two afternoon momentum trades, sharing strategies for capitalizing on market movements based on specific catalysts and price actions.

1:08:01

1:08:01| Metric | Observed | Expected |

|---|---|---|

| Views | 16,143 | 14,648 |

| Likes | 554 | 521 |

In this episode of the Trading Floor podcast, Garrett Dryin and Tim discuss the crucial role of selecting the right stocks for profitable trading, emphasizing that even the best indicators and patterns become ineffective without the proper context. They share insights on identifying stocks with potential and the importance of thematic trading to enhance success rates in the market.

8:06

8:06| Metric | Observed | Expected |

|---|---|---|

| Views | 8,475 | 14,620 |

| Likes | 389 | 521 |

In this video, Mike Belluri shares five practical tips designed to enhance your trading psychology, drawn from his own experiences and insights from elite traders. By implementing these strategies, including a pre-flight checklist and effective sizing techniques, traders can significantly improve their decision-making and overall performance in the market.

14:16

14:16| Metric | Observed | Expected |

|---|---|---|

| Views | 29,989 | 14,648 |

| Likes | 962 | 521 |

In this video, Jeff Holden from SMB Capital reveals a crucial tape reading skill that can significantly improve your trading success by teaching you how to identify pivotal moments when buyers take control of a stock. He emphasizes the importance of understanding market dynamics to avoid common pitfalls and provides actionable strategies to harness this skill for more profitable trades.

21:22

21:22| Metric | Observed | Expected |

|---|---|---|

| Views | 16,147 | 14,692 |

| Likes | 526 | 521 |

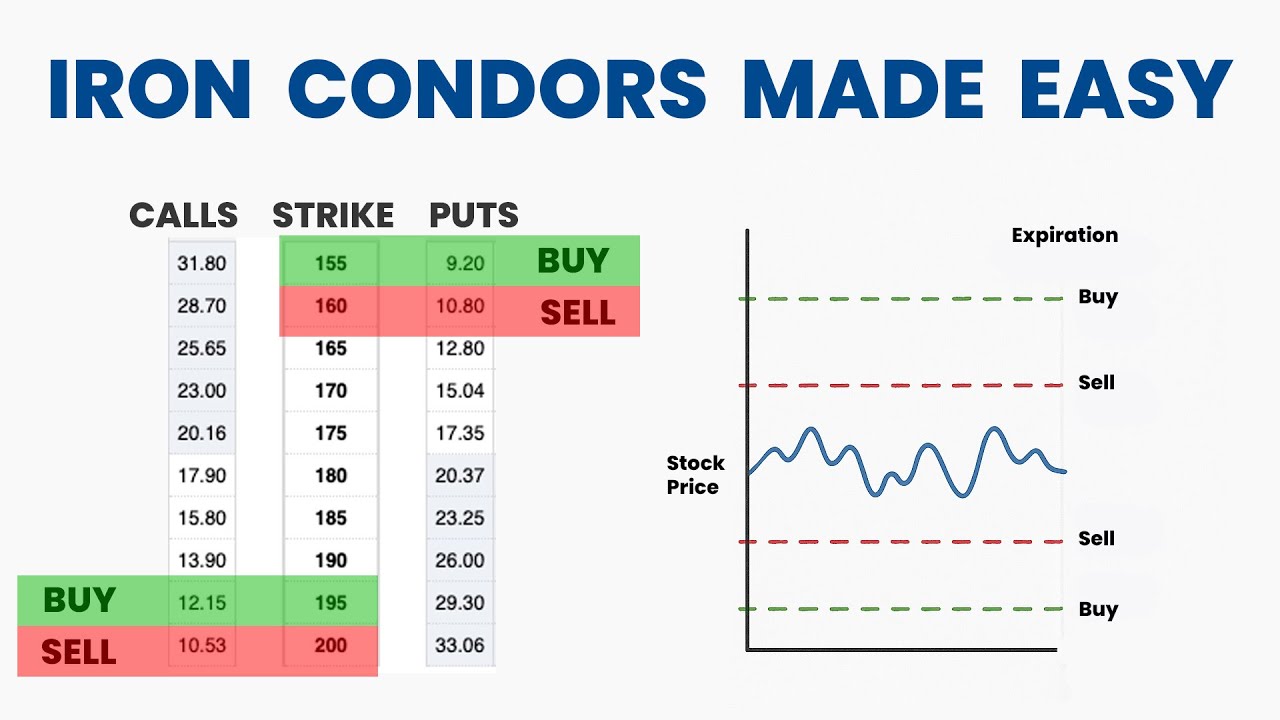

In this video, you'll discover how to easily implement the iron condor options strategy in just two steps, helping you gain control over your options trading success. Learn how to manage risk, utilize time decay to your advantage, and put this powerful strategy to work regardless of market direction.

40:10

40:10In this Moving Average Trading Tutorial, Jeff Holden from SMB Capital shares his effective strategy for day trading using the 9 EMA as a key indicator. He explains how to identify entry points, manage risk, and gain a consistent edge in trading, while also featuring insights from a fellow trader who employs a slightly different approach.

7:08

7:08In this video, Mike Bellafuri breaks down the compelling setup behind one of the biggest short trades of the year involving the stock BYND, which experienced a dramatic surge followed by a significant collapse. Watch as he explains the trading strategy, key signals, and profit targets that led to a successful short amid the chaos of meme stock trading.

14:40

14:40In this video, learn how to consistently make high-probability trades with an 80% chance of profit every day by focusing on well-defined setups rather than random trades. Discover the step-by-step process to implement effective options trading strategies using technical indicators like VWAP, enabling you to capitalize on daily market opportunities for significant returns.