ASX 200 Faces a Key Test — Bull Trend at Risk? | Stock Market Technical Analysis

PT18M57S

PT18M57S PT18M57S

PT18M57S PT17M54S

PT17M54S PT20M22S

PT20M22S PT10M29S

PT10M29S PT10M47S

PT10M47Ssentences.In this week’s ASX strategy session filmed from Hanoi, the host explains that the ASX 200 has been trapped in a shallow consolidation phase, still preserving a bullish structure but requiring a decisive break above the mid‑December high to reignite momentum, while remaining open to possible pull‑backs toward key moving averages. He then highlights that U.S. indices—including the S&P 500, Dow Jones and Russell 3000—are showing broad, upward participation with new highs and rising moving averages, reinforcing a continued long‑bias approach until clear evidence of a top emerges.

PT15M5S

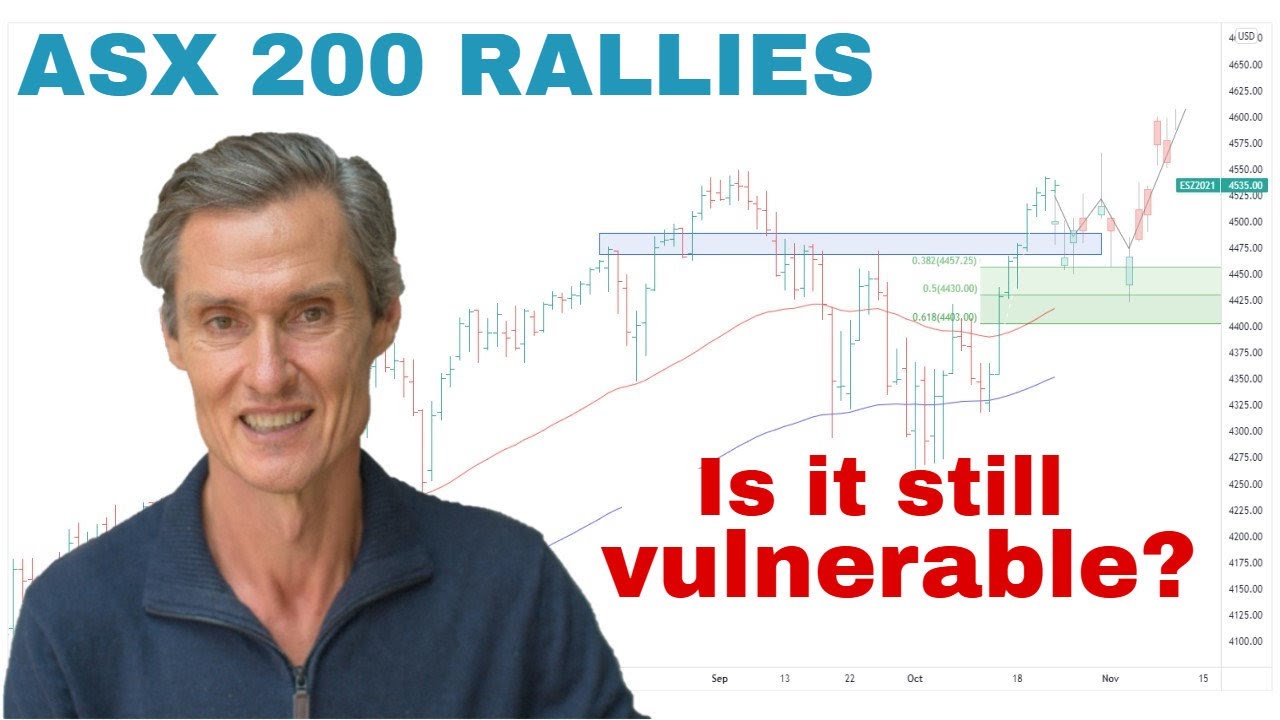

PT15M5SIn this holiday‑edition strategy session, the host reviews the ASX 200’s recent rally, noting that while the index has moved back above declining moving averages and the equal‑weight index shows broad support, the underlying structure remains technically vulnerable until consistent upside breaks are confirmed. He then expands the analysis to the US markets, highlighting the S&P 500’s near‑record highs, a bearish divergence in the Nasdaq, and the impact of US 2‑year Treasury yields on future market direction.

PT18M46S

PT18M46SIn this week's ASX strategy session, the host discusses the critical position of the ASX 200, currently in the sell zone, and analyzes potential market movements based on key price levels. The video also explores trends in the S&P 500 and various commodities, providing insights into market behavior and offering a forecast for the end of the year.

PT19M44S

PT19M44SIn this week's live ASX strategy session, the focus is on the ASX 200 as it approaches a key sell point, with discussions on recent market movements, financial indices, and critical resistance levels. The analysis explores whether current trends indicate a continuation of the upward momentum or a potential downturn, highlighting the importance of understanding broader market dynamics through equal-weighted perspectives.

PT22M59S

PT22M59SIn this week's ASX strategy session, we analyze the ASX 200's struggle to break above the 8,600 resistance level, raising questions about potential market breakdowns. Despite recent market vulnerabilities, the session highlights encouraging signs in financials and materials, suggesting that a significant rally may still be on the horizon.

PT21M1S

PT21M1SIn this week's ASX strategy session, we examine the stalled rebound of the ASX 200 in light of a larger sell-off risk, detailing the implications of current price action and key resistance levels. The discussion also includes insights into the performance of the financial and materials sectors, as well as technical indicators affecting the broader market trends.

PT21M7S

PT21M7SIn this week's ASX strategy session, the host analyzes the recent double breakdown of the ASX 200 index, discussing its implications for investors while highlighting the importance of interpreting moving averages. The session also covers broader market trends and offers insights into managing risks effectively amidst current volatility.

PT23M12S

PT23M12SIn this live ASX strategy session, the host analyzes the recent breakdown of the ASX 200, discussing its implications and key risk areas for investors. As they examine market movements, including the role of financials and broader sentiment, they emphasize maintaining a calm approach and strategic planning in response to volatility.

PT19M21S

PT19M21SIn this week's ASX strategy session, we analyze the ASX 200 as it approaches a critical support level at around 8,600, discussing whether it will hold or break amidst ongoing market consolidation. The video also highlights key technical indicators and trends, providing insight into potential future price actions and the importance of follow-through buying.

PT22M12S

PT22M12SIn this live ASX strategy session, the host analyzes the recent pullback in the ASX 200, discussing whether it's a temporary dip or the precursor to a more significant downturn. He examines various market indicators and sectors, ultimately suggesting that this movement appears to be a corrective phase within an overall bullish trend.

PT17M37S

PT17M37SIn this week's ASX strategy session, the presenter analyzes the ASX 200's recent price action, indicating a bullish trend as investors continue to buy the dips, supported by rising moving averages. They also explore key sectors like financials and materials that further strengthen this positive outlook amidst mixed sentiment in the U.S. markets.

PT17M40S

PT17M40SIn this week's ASX strategy session, the host analyzes the ASX 200 index, which recently reached a record high and discusses whether this signals a new upward trend or a potential pullback. He also highlights the importance of moving averages and market indicators, suggesting that while the overall trend remains bullish, upcoming price action will be crucial in determining the market's direction.

PT17M47S

PT17M47SIn this week's ASX strategy session, we examine the current state of the ASX 200, highlighting a consolidation phase amidst a backdrop of recent rallies and gains in mid and small-cap stocks. With a technical analysis of price movements and key indicators, the discussion focuses on potential future paths for the index and emphasizes maintaining a bullish outlook while preparing for possible pullbacks.

PT17M33S

PT17M33SIn this week's ASX strategy session, we analyze the current state of the ASX 200, highlighting its potential for continued upward movement despite recent consolidations. Additionally, we explore historical trends from the S&P 500 that suggest a favorable outlook for the remainder of the year, encouraging investors to remain long in stocks.

PT15M44S

PT15M44SIn this ASX 200 strategy session, the host discusses the index's current consolidation phase, analyzing key support levels and the potential for a breakout or breakdown in the coming weeks. With insights into US market trends and commodities, the video provides a comprehensive overview of market dynamics and technical indicators that could influence future price movements.

PT17M37S

PT17M37SJoin this week's ASX 200 strategy session as we analyze key market movements, including the impact of recent U.S. rate cuts and the market's current pullback. Discover essential technical insights on the ASX 200's consolidation patterns and learn what to watch for in the upcoming weeks, all while preparing for your stock queries in the second half of the show.

PT19M39S

PT19M39SIn this live strategy session, the host analyzes recent movements in the ASX 200 following its largest decline in five months, highlighting a stabilization near the 50-day moving average and suggesting that this could indicate a potential bullish trend. The discussion also touches on the S&P 500's new all-time highs, the broader market's strength, and the importance of managing risks while staying positioned for further upside in the stock market.