Dollars are Not Printed - They are LOANED into Existence

PT11M37S

PT11M37S PT11M37S

PT11M37S PT11M19S

PT11M19S PT8M19S

PT8M19S PT10M23S

PT10M23S PT14M7S

PT14M7S PT11M37S

PT11M37S PT8M27S

PT8M27S PT14M47S

PT14M47S PT13M29S

PT13M29S PT13M18S

PT13M18SThe video argues that the Federal Reserve is not truly independent, contending its policies primarily serve government fiscal goals and are increasingly vulnerable to executive‑branch control. It asserts that free‑market banking could replace the Fed’s functions and warns that politicized control will worsen inflation, erode wealth, and destabilize the economy.

PT13M45S

PT13M45SJoe Brown explains that the apparent bubble in every major asset class—including U.S. housing—stems from the dollar’s rapid loss of purchasing power, making cash holdings a guaranteed loss in real terms. He then outlines his diversified, gold‑anchored portfolio and aggressive trading approach, inviting viewers to a free “Portfolio Accelerator Master Class” on January 15 to learn how to protect and grow wealth.

PT14M40S

PT14M40SThe video argues that excessive government intervention—such as 50‑year mortgages, bans on institutional investors, and renewed purchases of mortgage‑backed securities—is worsening the U.S. housing crisis by inflating demand without addressing fundamental supply problems. It warns that these short‑term, politically driven fixes will further entrench wealth disparities and make homeownership increasingly unattainable for future generations.

PT22M48S

PT22M48SThe video contends that many of today’s economic crises—student‑loan debt, housing unaffordability, inflation, and the expanding power of the federal government—share a single root cause and can be resolved by allowing student loans to be discharged in bankruptcy, eliminating federally backed loans, and restoring free‑market mechanisms such as deregulated zoning and the removal of the Federal Reserve. It then urges viewers to protect themselves through personal financial actions (e.g., sound‑money assets, cash‑flowing real‑estate, higher‑income skills) and invites them to a free Portfolio Accelerator masterclass that teaches a trading strategy designed to profit from market chaos.

PT8M24S

PT8M24SThe video argues that the United States, facing an unsustainable debt burden and inflation caused by decades of costly wars, toppled Venezuela’s Maduro regime not for oil or drugs but to secure the country’s critical rare‑earth and heavy‑crude resources as part of a new, Western‑hemisphere‑centric world order. It warns that this strategic pivot toward resource nationalism and de‑globalization will reshape global power dynamics and calls viewers to rethink traditional investment approaches.

PT21M21S

PT21M21SThe video explains that AI, like every past technology, is a fundamentally deflationary force colliding with today’s inflation‑driven monetary system, which fuels extreme utopian and dystopian forecasts about the economy. By reviewing historical cycles of growth, creative destruction, and monetary policy, the creator recommends preparing for both inflation and deflation through adaptable skills and real‑value assets.

PT14M33S

PT14M33SAs of December 2025, silver has surged over 160% to more than $75 an ounce, a rally fueled by record industrial demand for EVs and solar panels, tight by‑product supply, export bans, and massive leveraged long and short‑squeeze activity. Nevertheless, the presenter warns that unaccounted above‑ground stock, possible substitution by cheaper metals, year‑end profit‑taking and margin‑call cascades could trigger a sharp pull‑back, so while he remains net‑long, he urges extreme caution.

PT15M16S

PT15M16SIn this video, I outline my expectations for the macroeconomic landscape in 2026, focusing on anticipated Federal Reserve rate cuts and the ongoing intertwining of fiscal and monetary policies. I also discuss the potential for increased volatility in the markets and share my investment strategy, emphasizing risk management and portfolio diversification.

PT13M56S

PT13M56SIn this video, learn about the urgent need to protect your wealth from potential financial repression and inflation by strategically moving assets outside the traditional financial system. The discussion highlights five key methods, including gold investment, Bitcoin, real estate, starting a business, and obtaining second citizenship to safeguard your future.

PT14M50S

PT14M50SIn this video, we explore the recent surge in US Treasury buybacks and their implications for the economy, highlighting how the government is preparing for future financial strategies amidst rising debt levels. By using short-term borrowing to buy back long-term debt, the Treasury aims to manage liquidity and potentially position itself for lower interest rates in the future.

PT20M53S

PT20M53SIn this video, we explore the best investment accounts for children's future savings, comparing the upcoming Trump accounts launching in 2026 with existing options like 529 plans and custodial accounts. Learn about potential seed money benefits, contribution limits, and the pros and cons of each account type to make informed decisions for your child's financial future.

PT1H26M17S

PT1H26M17SJoin us for an engaging live stream on December 16th as we dive into the latest jobs reports, market trends, and a variety of financial topics. Our host also shares insights on the technical challenges faced while using OBS for streaming and the significance of staying informed about economic indicators.

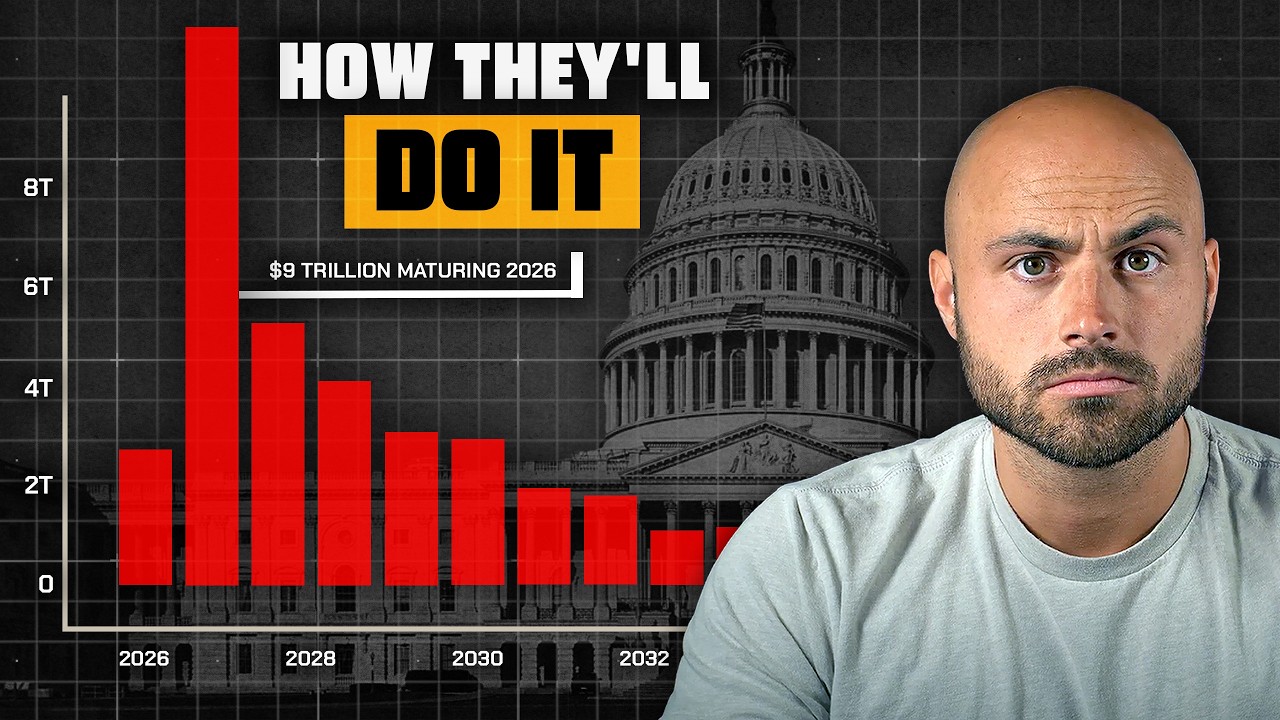

PT15M11S

PT15M11SIn this video, we explore the implications of the United States needing to roll over $9 trillion of national debt due in 2026. Despite concerns about government defaults and rising interest costs, the majority of this debt will likely be automatically refinanced, as much of it is held in Treasury bills that can be rolled over, keeping the financial system stable.

PT11M37S

PT11M37SIn this video, we analyze the Federal Reserve's abrupt decision to restart quantitative easing (QE) just 12 days after ending quantitative tightening (QT), highlighting the implications for the economy and the money supply. Despite the Fed's claims that this move is solely for reserve management, the reality is an expansion of money supply that could impact prices across various sectors.

PT1H37M16S

PT1H37M16SJoin us live as we discuss the Federal Reserve's latest monetary policy changes and the implications of transitioning from quantitative tightening (QT) to quantitative easing (QE). Dive into the nuances of balance sheet management, interest rates, and what this means for your investments with insights from our engaging Q&A session.

PT18M27S

PT18M27SIn this video, we explore the Federal Reserve's recent decision to officially end quantitative tightening (QT) and what implications this has for the economy, particularly regarding liquidity and interest rates. The discussion highlights how the Fed’s balance sheet management will affect government borrowing and the potential for changes in short-term interest rates in the near future.

PT1H53M58S

PT1H53M58SIn this live recap from December 9, the market exhibits minimal movement, with silver experiencing a notable breakout of 4% while gold remains flat. The discussion also includes insights on Bitcoin, trading strategies, and investment principles, including the importance of financial responsibility and understanding market dynamics.

PT7M53S

PT7M53SIn this video, we explore whether the Trump administration's plans to roll back fuel efficiency standards will truly lead to cheaper cars for consumers. While the changes may alleviate some burdens for manufacturers, the reality is that significant price drops are unlikely without broader legislative action to address safety regulations and market monopolies.

PT8M11S

PT8M11SIn this video, we explore the paradox of a collapsing job market marked by over 1.1 million layoffs announced this year, yet simultaneously see a significant drop in jobless claims reaching a three-year low. We delve into the reasons behind this discrepancy, focusing on the nature of layoffs, eligibility for unemployment benefits, and the resilience of those finding new jobs despite looming job losses.

PT1H44M38S

PT1H44M38SIn this week's Q&A Friday Market Wrap, the host discusses recent market fluctuations, particularly focusing on Bitcoin's bearish pattern and the outlook for energy stocks. Viewers can expect insights on market trends, investment strategies, and the importance of understanding long-term debt cycles in the current economic landscape.

PT1H21M48S

PT1H21M48SIn this live market close update for December 4, the speaker discusses recent bullish trends in the market and analyzes implications of new deregulation in the auto industry, clarifying misconceptions about the availability of foreign vehicles in the U.S. He also examines conflicting job market data, including rising layoffs and decreasing initial jobless claims, and opens the floor for audience questions on various investment topics.

PT16M8S

PT16M8SIn this video, we explore the troubling decline of Bitcoin in 2025, examining factors like MicroStrategy's financial practices, the selling behavior of long-term holders, and shifting narratives in the cryptocurrency market. With Bitcoin's volatility intensifying amid significant sell-offs, we analyze whether this marks a pivotal moment for the cryptocurrency's future or if it's merely a temporary setback.