Is the 2026 Gold Rally Running Out of Steam?| Weekly Commodities Review

PT7M5S

PT7M5S PT7M5S

PT7M5S PT10M

PT10M PT5M12S

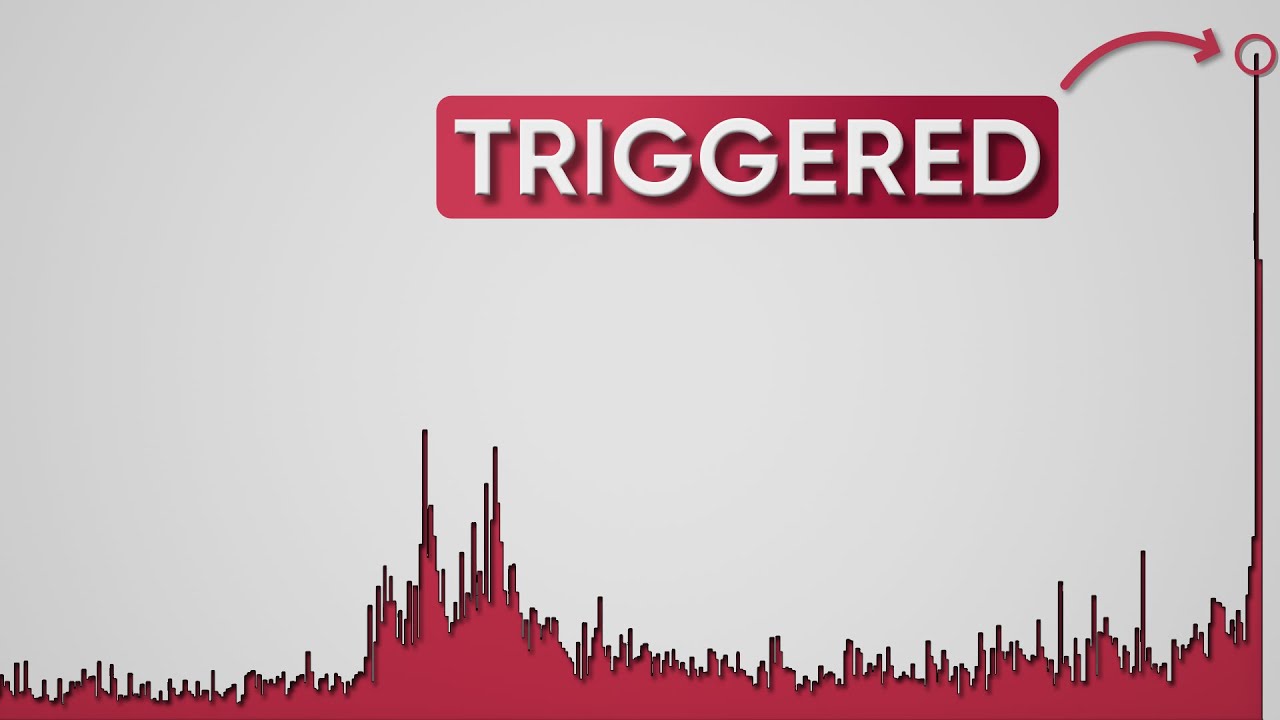

PT5M12S| Metric | Observed | Expected |

|---|---|---|

| Views | 54,653 | 1,439 |

| Likes | 1,180 | 52.5 |

PT5M19S

PT5M19S| Metric | Observed | Expected |

|---|---|---|

| Views | 17,484 | 1,228 |

| Likes | 369 | 50 |

PT5M52S

PT5M52S| Metric | Observed | Expected |

|---|---|---|

| Views | 11,582 | 1,228 |

| Likes | 270 | 50 |

PT7M27S

PT7M27S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,375 | 1,228 |

| Likes | 61 | 50 |

PT5M7S

PT5M7S| Metric | Observed | Expected |

|---|---|---|

| Views | 6,864 | 1,228 |

| Likes | 185 | 50 |

PT11M16S

PT11M16S| Metric | Observed | Expected |

|---|---|---|

| Views | 2,012 | 1,329 |

| Likes | 67 | 50 |

PT9M57S

PT9M57S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,966 | 1,329 |

| Likes | 61 | 50 |

PT8M39S

PT8M39S| Metric | Observed | Expected |

|---|---|---|

| Views | 3,040 | 1,329 |

| Likes | 79 | 50 |

PT8M3S

PT8M3S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,262 | 1,329 |

| Likes | 46 | 50 |

PT9M36S

PT9M36S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,317 | 1,329 |

| Likes | 57 | 50 |

PT10M59S

PT10M59S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,325 | 1,402 |

| Likes | 56 | 47 |

PT8M28S

PT8M28S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,227 | 1,402 |

| Likes | 26 | 47 |

PT5M25S

PT5M25S| Metric | Observed | Expected |

|---|---|---|

| Views | 5,935 | 1,402 |

| Likes | 170 | 47 |

PT8M3S

PT8M3S| Metric | Observed | Expected |

|---|---|---|

| Views | 934 | 1,402 |

| Likes | 50 | 47 |

PT9M27S

PT9M27S| Metric | Observed | Expected |

|---|---|---|

| Views | 611 | 1,402 |

| Likes | 37 | 47 |

PT5M17S

PT5M17S| Metric | Observed | Expected |

|---|---|---|

| Views | 3,366 | 1,402 |

| Likes | 68 | 47 |

PT8M39S

PT8M39S| Metric | Observed | Expected |

|---|---|---|

| Views | 2,073 | 1,402 |

| Likes | 75 | 47 |

David Jones analyzes three key markets—NASDAQ, copper and gold—pointing out the NASDAQ’s rangebound state, copper’s record‑breaking rally and his decision to hold off on a copper trade until the breakout solidifies. He then adds to his gold position, buying at 4,631 with a 4,350 stop, while noting a bearish RSI divergence as a short‑term warning but trusting the overall uptrend.

PT6M33S

PT6M33S| Metric | Observed | Expected |

|---|---|---|

| Views | 3,141 | 1,402 |

| Likes | 67 | 47 |

In this video, David Jones of Capital.com reviews the recent surge of gold to fresh all‑time highs, explains the geopolitical and Federal Reserve factors behind the rally, and provides an update on his own long position opened in November. He then highlights key support zones around $3,800‑$4,400, notes that a pullback below $4,500 could present a buying opportunity, and advises using tight stops to trade either strength or weakness in the ongoing uptrend.

PT7M28S

PT7M28S| Metric | Observed | Expected |

|---|---|---|

| Views | 11,617 | 1,402 |

| Likes | 93 | 47 |

The video examines Bitcoin’s historic 4‑year cycle—17 months of rally followed by a 12‑month bear market—and shows that while the cycle suggests a potential dip toward $30 k by late 2026, today’s on‑chain metrics are neutral, institutional holdings have surged from $10 bn to over $130 bn (now accounting for roughly 50 % of price moves), and the ISM PMI is edging toward expansion, all of which could keep the bull market alive. It also warns that the next 12 months hinge on whether the PMI stays strong or contracts, with recession odds currently around 25 %, making those macro signals the key gauges for Bitcoin’s future trajectory.

PT9M34S

PT9M34S| Metric | Observed | Expected |

|---|---|---|

| Views | 627 | 1,402 |

| Likes | 19 | 47 |

In this weekly market roundup, David Jones reviews the latest fresh all‑time highs in the S&P 500, gold, and Japan’s Nikkei while assessing the impact of a new criminal investigation into Fed Chair Jerome Powell and the resulting volatility across the US dollar, oil, and other major assets. He shares his current trade positions, outlines key support and resistance levels, and offers insight on whether these record‑setting moves present buying opportunities or signal looming trouble.

PT5M14S

PT5M14S| Metric | Observed | Expected |

|---|---|---|

| Views | 151,033 | 1,402 |

| Likes | 1,744 | 47 |

The video explains how Amazon’s stock has trailed rivals like Google, Microsoft, and Walmart over the past five years—mirroring a previous 2011‑2015 slump that later turned into a massive rally—while investors remain wary of its e‑commerce margins and the slowing growth of its high‑margin AWS cloud division. It then argues that massive AI‑driven demand, record capital spending on data‑center expansion, and a partnership with OpenAI could reignite AWS’s growth and spark a new Amazon rally, though a slowdown in AI adoption or cloud‑budget cuts would keep the stock volatile.

PT10M27S

PT10M27S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,696 | 1,402 |

| Likes | 34 | 47 |

In the talk, Mark Ellis, founder and CIO of Nutshell Asset Management, explains how his actively managed, relative‑value, quality‑growth strategy capitalises on heightened volatility—such as the market drop on “liberation day”—by quickly recalibrating the portfolio and redeploying capital into the best‑priced opportunities. He highlights the fund’s out‑performance (27% + recent returns), its heavy allocation to high‑ROIC, stable‑margin companies, the current cheapness of many holdings, and the macro risks (election cycle, Trump‑driven headlines, geopolitical shocks) that shape their investment outlook for 2026.

PT10M17S

PT10M17S| Metric | Observed | Expected |

|---|---|---|

| Views | 577 | 1,402 |

| Likes | 27 | 47 |

sentences.In this update the host breaks down the latest action across five markets—NASDAQ’s tech index stuck in a sideways range, the Spanish 35 index surging over 50% since last year, Bitcoin holding a two‑year uptrend above its April‑2025 low, the GBP/USD showing a modest rebound toward the 13,500‑13,600 zone, and natural gas rattling after a 40% plunge from its three‑year high. He highlights key support and resistance levels, shares his recent trade adjustments, and invites viewers to subscribe and join the channel’s Telegram for more real‑time analysis.

PT6M21S

PT6M21S| Metric | Observed | Expected |

|---|---|---|

| Views | 14,806 | 1,402 |

| Likes | 168 | 47 |

.In this update the host reviews silver’s near‑tripling in 2025, its recent run to an $84 all‑time high, and outlines a “buy‑the‑dip” plan with stops around $68–$77 while weighing the possibility of taking profits if the rally stalls. Subscribe for more market analysis and join the Telegram channel (link in the description) for real‑time alerts.

PT9M44S

PT9M44S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,350 | 1,402 |

| Likes | 68 | 47 |

.In this New Year update, the analyst reviews recent performance and his current positions in oil (short), gold (long), and the German DAX, offering insights on market reactions to the US‑Venezuela situation and recent price moves. He then places a breakout long trade on the DAX at 24,900 with a 24,350 stop, outlines his outlook for oil and gold, and encourages viewers to subscribe and join his Telegram for further analysis.

PT8M57S

PT8M57S| Metric | Observed | Expected |

|---|---|---|

| Views | 1,332 | 1,402 |

| Likes | 56 | 47 |

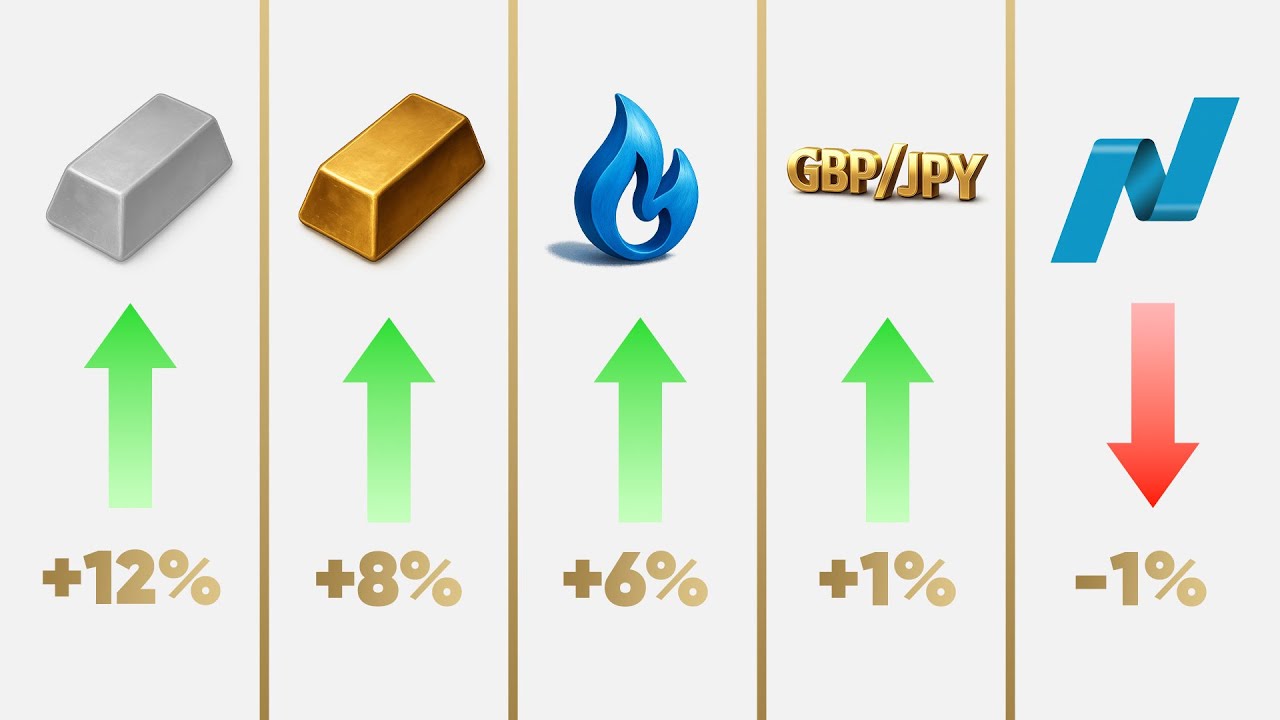

In this live trading session, we analyze key markets that defined 2025, focusing on the impressive performance of silver, the steady finish of the NASDAQ, and the lackluster trend in oil prices. As we look ahead to January and 2026, we'll discuss open positions, trading strategies, and the potential for market shifts in these sectors.

PT5M28S

PT5M28S| Metric | Observed | Expected |

|---|---|---|

| Views | 8,771 | 1,402 |

| Likes | 171 | 47 |

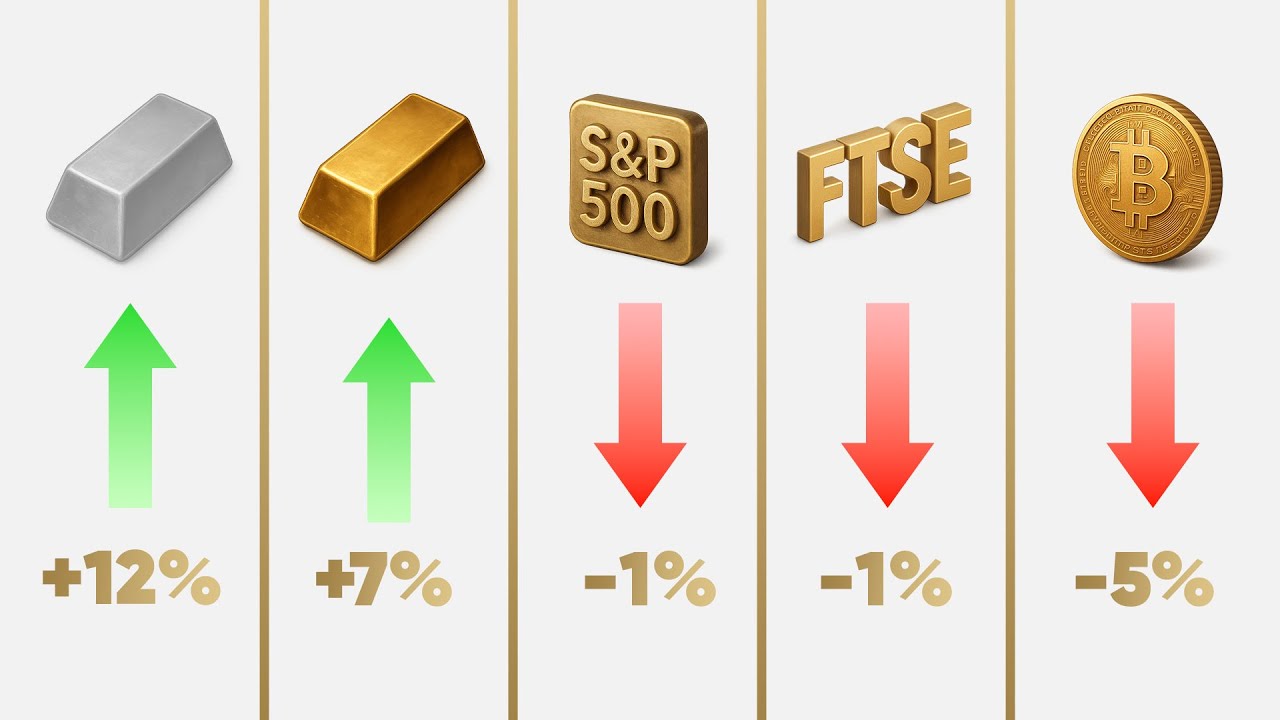

In this video, we explore the shocking performance of the US dollar, which has recorded its worst performance since 1973, falling over 10% this year, while some emerging markets boast staggering stock index gains. However, these impressive returns are illusory when adjusted for currency devaluation, highlighting the importance of evaluating investments in the context of inflation and money supply.

10:39

10:39| Metric | Observed | Expected |

|---|---|---|

| Views | 1,907 | 1,402 |

| Likes | 39 | 47 |

In this episode of "Talking Markets," George Cooper, Chief Investment Officer at Equitile, discusses the decline of the Magnificent 7 tech stocks while emphasizing a more optimistic outlook for undervalued sectors like banking and gold mining. He also warns investors about bubbles in certain market areas and suggests a strategic approach to navigating investments in the evolving economic landscape.

5:15

5:15| Metric | Observed | Expected |

|---|---|---|

| Views | 3,235 | 1,402 |

| Likes | 102 | 47 |

In this video, we explore Warren Buffett's record-breaking cash pile of $381 billion and his ongoing strategy of selling stocks while the market remains near all-time highs. By examining Buffett's historical caution during market bubbles, we uncover the reasoning behind his patient approach to investment amid today's elevated valuations and economic indicators.

35:00

35:00| Metric | Observed | Expected |

|---|---|---|

| Views | 867 | 1,402 |

| Likes | 25 | 47 |

In this week's Market Monday webinar, analysts Kyle and Danny discuss the recent Federal Reserve developments and their impact on gold and silver markets, noting gold prices are nearing record levels while silver appears overvalued. They also examine upcoming economic data and central bank meetings, emphasizing the importance of AI's influence on productivity and market valuations as we approach 2026.

6:08

6:08| Metric | Observed | Expected |

|---|---|---|

| Views | 12,344 | 1,402 |

| Likes | 179 | 47 |

In this video, we explore the alarming state of housing affordability in America, where the average income required to purchase a home has skyrocketed, making homeownership increasingly unattainable for many. Despite low foreclosure rates, the dominance of institutional investors and rising costs are exacerbating the crisis, leaving everyday Americans struggling to save for a home while rental prices continue to soar.

5:25

5:25| Metric | Observed | Expected |

|---|---|---|

| Views | 1,687 | 1,402 |

| Likes | 55 | 47 |

In this video, David Jones discusses the current state of the oil market, focusing on a critical price floor at $55 that could influence trading strategies going into 2026. He analyzes recent trading activity, highlights his own positions, and speculates on potential market movements based on historical price trends.

13:44

13:44| Metric | Observed | Expected |

|---|---|---|

| Views | 672 | 1,402 |

| Likes | 24 | 47 |

In this video, Capital.com’s global analysts dissect the recent Federal Reserve actions signaling potential interest rate cuts, the implications for the U.S. dollar, and the surge in gold prices driven by market volatility. They also explore broader market dynamics, including the performance of tech stocks and the current state of oil and silver markets as they navigate the complexities of economic indicators and geopolitical risks.

8:48

8:48| Metric | Observed | Expected |

|---|---|---|

| Views | 848 | 1,410 |

| Likes | 38 | 47 |

In this live trading session, David Jones analyzes the current market trends for Bitcoin, the German DAX, and silver, putting a particular focus on Bitcoin's critical $74,000 level amid debates about the recent price drop. He shares insights on his trade decisions, highlighting the potential for recovery in these markets and the importance of staying informed for future opportunities.

6:12

6:12| Metric | Observed | Expected |

|---|---|---|

| Views | 1,644 | 1,403 |

| Likes | 55 | 47 |

In this video update, David Jones discusses the recent surge of silver to all-time highs, examining the factors contributing to its impressive 20% increase. He highlights key levels to watch for potential buying opportunities, emphasizing the importance of market trends and technical analysis.