Ask Alan #239: Using 2 Standard Deviations to Avoid Covered Call Exercise

PT17M3S

PT17M3S PT17M3S

PT17M3S PT10M55S

PT10M55S| Metric | Observed | Expected |

|---|---|---|

| Views | 111 | 97 |

| Likes | 3 | 4 |

PT11M40S

PT11M40S| Metric | Observed | Expected |

|---|---|---|

| Views | 127 | 97 |

| Likes | 4 | 4 |

PT20M42S

PT20M42S| Metric | Observed | Expected |

|---|---|---|

| Views | 167 | 126 |

| Likes | 12 | 6 |

PT9M46S

PT9M46S| Metric | Observed | Expected |

|---|---|---|

| Views | 165 | 151 |

| Likes | 5 | 6 |

PT15M18S

PT15M18S| Metric | Observed | Expected |

|---|---|---|

| Views | 184 | 151 |

| Likes | 6 | 6 |

PT13M56S

PT13M56S| Metric | Observed | Expected |

|---|---|---|

| Views | 264 | 151 |

| Likes | 9 | 6 |

PT10M2S

PT10M2S| Metric | Observed | Expected |

|---|---|---|

| Views | 143 | 151 |

| Likes | 5 | 6 |

PT13M41S

PT13M41S| Metric | Observed | Expected |

|---|---|---|

| Views | 307 | 159 |

| Likes | 8 | 6 |

In this episode Alan Elman explains why investors may choose to roll out an in‑the‑money covered call—buying to close the expiring option and selling a new one in the next cycle—using a detailed United Therapeutics trade to show how the modest time‑value cost can lock in a favorable cost basis, protect against weekend price risk, and potentially boost annualized returns. He also outlines the calculations that justify the strategy and points viewers to the BlueCollar Investor’s courses, spreadsheets, and books for deeper training.

PT7M25S

PT7M25S| Metric | Observed | Expected |

|---|---|---|

| Views | 124 | 159 |

| Likes | 9 | 6 |

Let's produce.In this video Alan Elman walks through a 12‑day out‑of‑the‑money covered‑call trade on Nvidia (NVDA), covering the stock’s technical setup, the $1.99 call premium, and the projected 1.07% (annualized >32%) return. He reports that the trade has already generated $398 in premium and remains just above breakeven, leaving the final outcome uncertain as expiration approaches.

PT12M12S

PT12M12S| Metric | Observed | Expected |

|---|---|---|

| Views | 177 | 159 |

| Likes | 7 | 6 |

informative.In this episode of the BCI Podcast, host Alan Elman walks through a real‑world covered‑call trade on Revolve Group (RVLV), showing how he entered two contracts three days apart, rolled the first in‑the‑money position out and up to a higher strike, and ultimately sold the shares at $63. He breaks down the calculations (including a 9.5% return over 24 days, ≈145% annualized), demonstrates the Trade Management Calculator, and promotes BCI’s educational packages.

PT11M44S

PT11M44S| Metric | Observed | Expected |

|---|---|---|

| Views | 124 | 160 |

| Likes | 6 | 6 |

In this video, Alan Elman, “the Blue Collar Investor,” breaks down a five‑day covered‑call trade he executed on Kinross Gold Corp. (KGC) from Dec 29, 2025 to Jan 2, 2026, explaining the stock’s strong fundamentals and technicals, the mix of in‑the‑money and out‑of‑the‑money options he sold, and the calculated returns; the trade closed with a net profit of $446 (≈1.61% of the $27,600 position, or 84% annualized) after accounting for a small stock loss. He also points viewers to free covered‑call training and resources available on thebluecollarinvestor.com.

PT11M10S

PT11M10S| Metric | Observed | Expected |

|---|---|---|

| Views | 167 | 196 |

| Likes | 5 | 6 |

In this video, Alan Elman, the Blue Collar Investor, shares a real-life example of a successful cash-secured put trade involving Kin Ross Gold Corp. (KGC) that generated a significant return in just three and a half trading days, highlighting key technical indicators and market conditions that contributed to the trade's success. He also emphasizes the importance of reviewing percentile returns rather than just dollar amounts while providing insights into option trading strategies for various market environments.

9:45

9:45| Metric | Observed | Expected |

|---|---|---|

| Views | 148 | 196 |

| Likes | 6 | 6 |

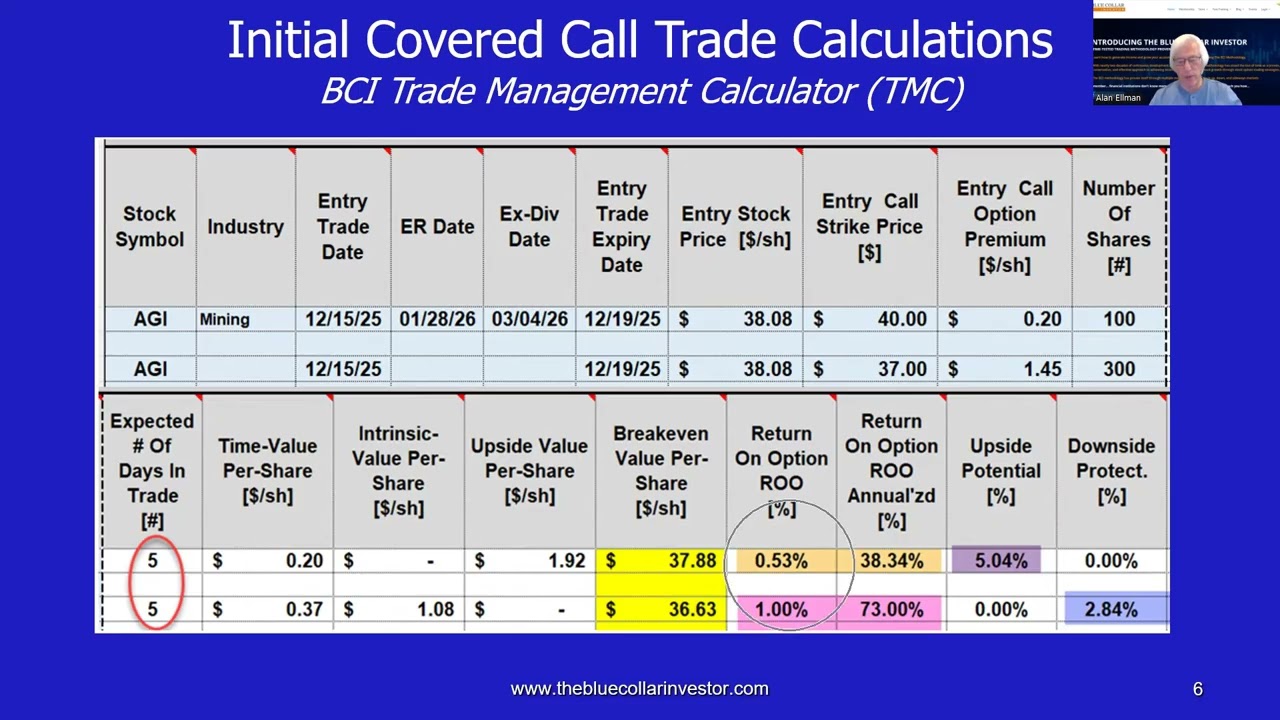

In this video, Alan Elman, also known as the Blue Collar Investor, demonstrates a real-life example of a sample trade involving Alamos Gold Inc. (AGI), where he executed three defensive in-the-money covered call options and one aggressive out-of-the-money call, showcasing the benefits of both strategies under modest implied volatility conditions. He discusses the technical indicators, market trends, and ultimately reveals impressive gains from this five-day trade, emphasizing the importance of aligning trading strategies with individual risk tolerance and market assessments.

13:43

13:43| Metric | Observed | Expected |

|---|---|---|

| Views | 144 | 196 |

| Likes | 11 | 6 |

In this episode of the BCI Podcast, Alan Elman explains how to generate multiple income streams by utilizing cash-secured put trades, using a real-life example with ZIM Integrated Shipping Services Limited. He highlights various strategies and exit maneuvers that can help exceed the initial maximum return widely assumed in put selling, ultimately aiming to enhance viewers' investment outcomes.

14:28

14:28| Metric | Observed | Expected |

|---|---|---|

| Views | 145 | 196 |

| Likes | 7 | 6 |

In this video, Alan Elman walks viewers through a real-life example of a 12-day cash-secured put trade on TTM Technologies, showcasing his defensive strategy amid market uncertainty and high implied volatility. He discusses the trade specifics, potential returns, and the importance of crafting trades to align with individual risk tolerances and market assessments.

12:54

12:54| Metric | Observed | Expected |

|---|---|---|

| Views | 241 | 196 |

| Likes | 6 | 6 |

In this episode of Ask Alan, Alan Elman addresses a viewer's question regarding strike selection after rolling out a portfolio overwriting trade, focusing on the balance between cash flow generation and share retention. He provides insights using a real-life example with Nvidia, demonstrating how to navigate options trading while maintaining investment goals and understanding the impact of option debits on future contracts.

14:57

14:57| Metric | Observed | Expected |

|---|---|---|

| Views | 164 | 196 |

| Likes | 7 | 6 |

Join Alan Elman, the Blue Collar Investor, as he provides a comprehensive guide on setting up option portfolios through effective stock selection, diversification, and cash allocation strategies. Utilizing six covered call trades, he demonstrates practical tools and calculations to efficiently manage risk and maximize returns in your investment portfolio.

12:14

12:14| Metric | Observed | Expected |

|---|---|---|

| Views | 135 | 160 |

| Likes | 6 | 6 |

In this episode of BCI Podcast 161, Alan Elman explores the collar strategy by examining a real-life example involving the leveraged ETF Labu, utilizing weekly calls and monthly puts to manage risk and potential returns. He explains the mechanics of the collar strategy and emphasizes the importance of understanding the risks associated with leveraged ETFs, while providing insights to help investors make informed trading decisions.

12:42

12:42In this sample trade video, Alan Elman discusses a recent cash-secured put trade involving Royal Gold Inc. (RGLD), executed with a defensive strategy amidst mixed market signals, aiming to generate income while managing risk. The analysis covers the stock's technicals, option details, and potential outcomes, emphasizing the importance of aligning trades with market conditions and personal risk tolerance.

5:02

5:02Join Alan Elman in the BCI Educational Webinar #9 on January 15, 2026, at 8:00 PM ET, where you'll learn how to use conservative stock options to create an additional income stream in your stock portfolio. This session will cover essential strategies such as covered call writing, credit spreads, and risk management, featuring real-life examples and live Q&A to enhance your investment knowledge.

16:06

16:06In this episode of the BCI Podcast, Alan Elman discusses the comparison between implied volatility and delta in establishing projected trading ranges for options contracts, using Nike Inc. as a primary example. He explains how these metrics contribute to a high probability of success in trading while providing practical insights and formulas for managing options contracts effectively.

17:05

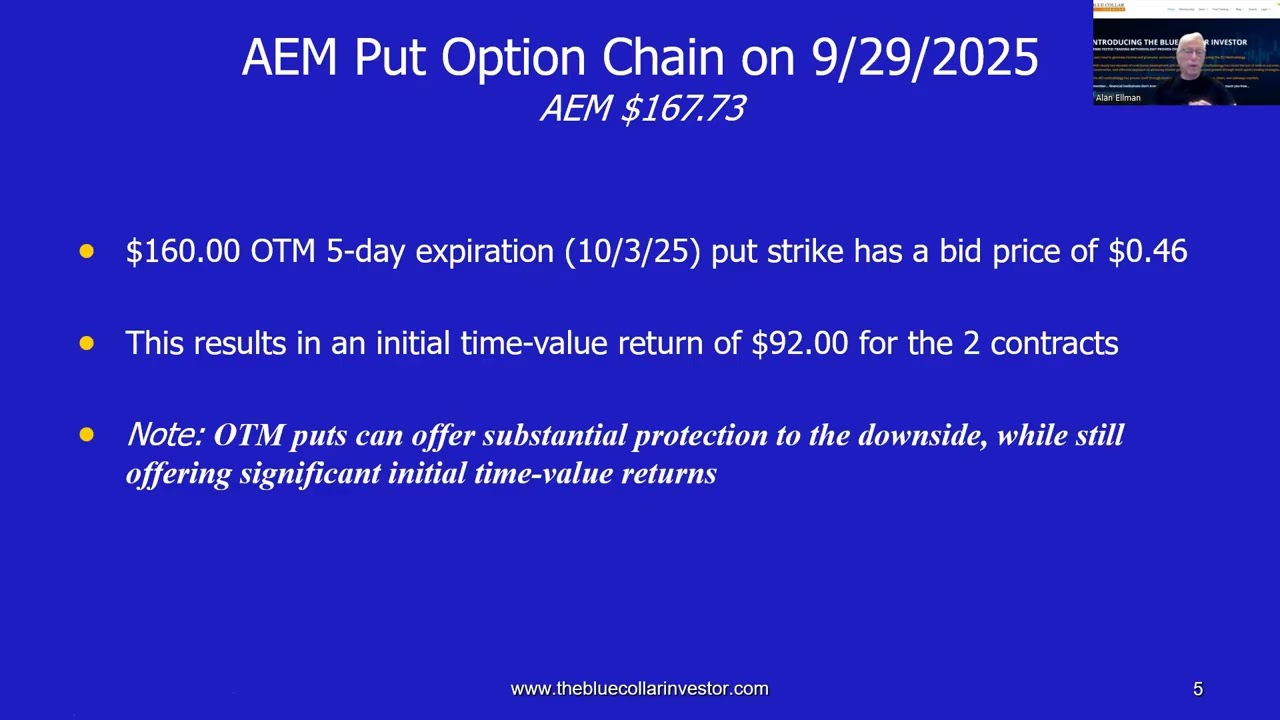

17:05In this episode of "Ask Alan," Alan Elman dives into the complexities of options trading, specifically focusing on calls, puts, and strategic exits through a detailed analysis of a viewer's trades with Agnico Eagle Mines Limited (AEM). Despite the heavy math involved, Alan breaks down each trade to draw invaluable lessons, emphasizing the importance of following established guidelines for successful options trading.

7:02

7:02In this video, Alan Elman provides an update on his 22-day cash-secured put trade with Amphenol Corp, discussing the adjustments made to enhance potential returns amid market fluctuations. He highlights the robust protection and impressive annualized returns achieved through strategic management of the trade, while encouraging viewers to explore further educational resources on trading strategies.

11:34

11:34In this episode of the BCI Podcast, Alan Elman explains the intricacies of one-time special cash dividends, using One Main Holdings Inc. as a real-life example, and discusses how these corporate events affect option trading contracts. He emphasizes the importance of understanding these adjustments to ensure that covered call writers and put sellers remain financially whole amidst changes in stock value.

11:45

11:45Join Alan Elman, the Blue Collar Investor, as he presents a detailed overview of a two-contract aggressive high implied volatility covered call trade involving Universal Technical Institute (UTI), expiring in just 26 days. Discover the potential returns and risks associated with this strategy while learning about the technical indicators that influenced his decision to choose UTI as a trade candidate.

12:02

12:02In this episode of BCI Podcast, Alan Elman discusses the strategy of rolling weekly 10-delta put options before a holiday weekend, using Etsy Inc. as a practical example. He explores the benefits, such as generating higher returns, and the potential downside of weekend risk, while providing insights into how to navigate this trading approach effectively.

11:20

11:20In this video, Alan Elman demonstrates a successful defensive cash-secured put trade involving Rambus (RMBBS), executed on September 22, 2025, and expiring on October 17, 2025. He discusses the technical indicators that informed his decision and highlights the trade's protective nature, ultimately generating a 20.57% annualized return despite market fluctuations.

13:24

13:24In this video, Alan Elman discusses a real-life example of a defensive high implied volatility and low delta cash-secured put trade he executed with Vertive Holdings (VRT). He explains the trade's strategy, the reasoning behind selecting VRT, and the successful results, emphasizing the potential for significant returns even in uncertain market conditions.

13:14

13:14In this video, Alan Elman presents a detailed analysis of a recent two-contract defensive cash-secured put trade involving Agnico Eagle Mines Limited (AEM), highlighting the stock's strong performance and favorable technical indicators. He emphasizes the trade's significant returns, risk management strategies, and the importance of aligning trades with current market conditions.